The Australian dollar versus the US dollar currency pair seems to be undecided. Is it so, or are the bears preparing a surprise?

Long-term perspective

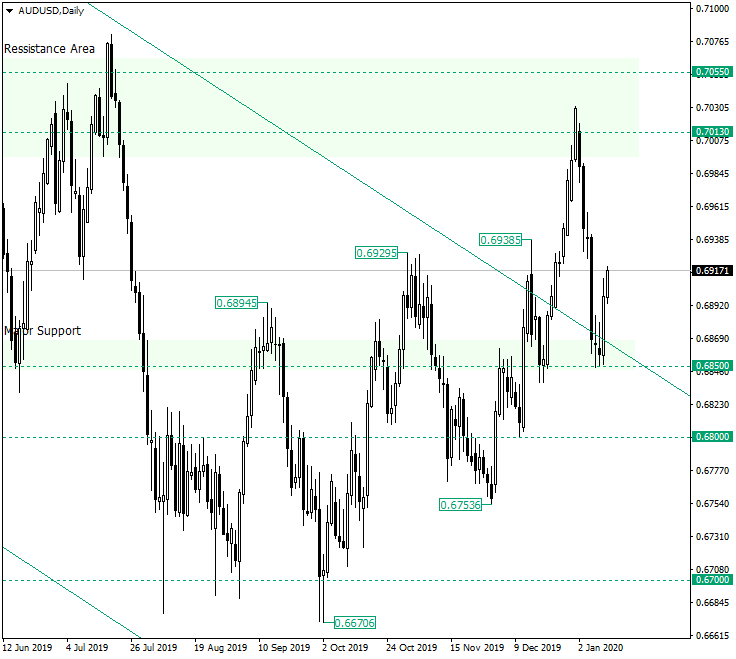

After printing the low of 0.6670 and confirming the 0.6700 psychological level as support, the price started an ascending trend.

Along its way, the price managed to conquer the major support of 0.6850 after a second run — the first attempt was a failure, as it printed the high of 0.6929 and then got back under the level — and extended to the important resistance area designated by 0.7055 and 0.7013, respectively.

From 0.7013 a sharp drop started, one that brought the price back to the major support of 0.6850. Once there, the price barely touched the level, but the result was a bullish engulfing. This, along with the fact that the level — together with the resistance trendline of the descending channel — represents part of a double support area, makes the bulls cheer, as the picture seems to put the shine on a possible appreciation. In other words, the bullish engulfing pattern — which is a strong one — formed after the price pierced a double resistance area, thus looking as if it turned it into a double support and hence spark a possible appreciation.

But this bullish dream may be shaded by the fact that the drop from 0.7013 retraced a lot beyond previous important highs, 0.6929 and 0.6938, respectively. Also, the strong depreciation could turn out to be the head of a head and shoulders pattern, with a left-side shoulder peaking at 0.6938 and the right-side one still to be formed.

So, as long the bullish engulfing pattern does not get invalidated — by price revisiting values slightly above 0.6850 — the appreciation may continue. But even so, attention must be dedicated to the highs of 0.6938 and 0.6929, respectively. The reason behind this is that the respective highs could stall the price, sending it beyond 0.6850.

So, if the bulls manage to go all the way, then 0.7013 is a good target. However, if the bears come into play around the aforementioned highs, then 0.6800 is the first target, and once touched, the door to the 0.6700 psychological level opens.

In the case of the bullish engulfing invalidation, only if the 0.6850 level is falsely pierced, then the bulls might have another chance to challenge the two peaks.

Short-term perspective

After not being able to sustain the gains above 0.7003, the price fell towards the next support, 0.6933, respectively. But it also was not able to keep the bears in check, and the drop to 0.6855 was thereby paved.

From there, an appreciation above the 50.0 Fibonacci retracement projection was printed. If the price succeeds in confirming it as support, then 61.8 (with the corresponding 0.6933 technical) are the first aim.

On the other hand, if 50.0 gives way, then 23.6 is the next target.

Levels to keep an eye on:

D1: 0.6850 0.7013 0.6800

H4: 0.6933 and the Fibonacci retracement projections of 50.0 61.8 23.6

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment