The US dollar versus the Japanese yen currency pair allowed a full-fledged bullish appreciation. Are they exhausted or is this just the beginning?

Long-term perspective

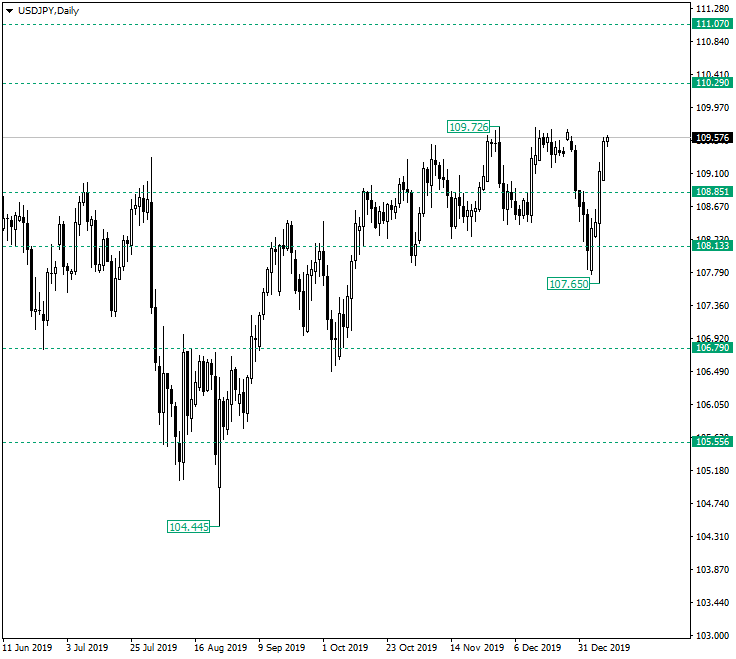

The appreciation that started after the low of 104.44 extended until the 109.72 area, from where a sideways movement commenced.

The bears tried to turn this pause into their next big drop, as with the beginning of 2020 they took out the previous lows and breached the 108.13 level.

But this was a short-lived event as the bulls took their positions and repelled the bullish attempt. The result was not only the success of withering the bears, but also the strong appreciation that facilitated the overtaking of 108.85 and the extension until the previous high’s area of 109.72.

Of course, after such a triumph, the bulls deserve their time off. This will translate on the charts as a throwback towards 108.85, with the purpose of confirming it as support.

So, the first possibility is for the price to test 108.85. A second scenario is also feasible: a short-term consolidation pattern, such a flag or a pennant. Irrespective of which scenario does materialize, the main profit taking area is represented by 110.29. From there, 111.07 is in reach.

On the other hand, if the second scenario is the one that does gets sketched, bullish discretion is of great avail, as if the price fails to confirm 108.85 as support, the bears might try to challenge 108.13 once again.

Short-term perspective

The price appreciated strongly from 107.92 and inscribed movement above 109.19, a level that served as a support for the side-ways phase that started on December 13.

As long as 109.19 maintains its role, further appreciation is in the cards, with the main target at 109.99.

However, if 109.19 gives way, the bulls may eye 108.43 to long the market at a better price. If this scenario unfolds, 109.19 would be a good place to park some of the profits.

Levels to keep an eye on:

D1: 108.85 110.29 111.07 108.13

H4: 109.19 109.99 108.43

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment