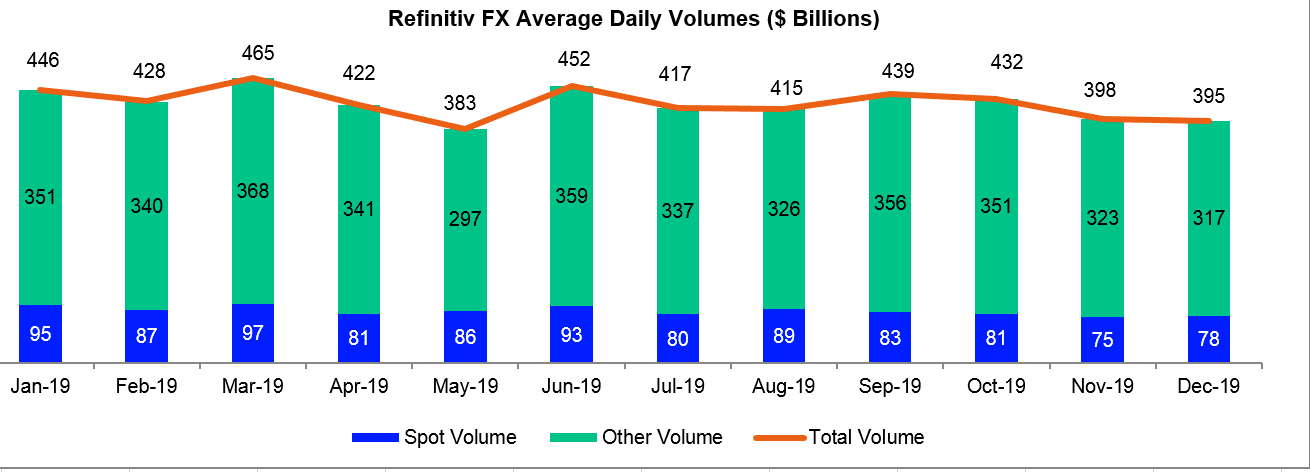

Refinitiv, the former , today reported that the average daily volumes (ADV) of currency trading were $395 billion last month on the company’s main FX trading services. December’s ADV figure is the lowest in seven months, namely since currency volumes bottomed out at $383 billion back in May 2019.

Volatility was coming back slowly to FX markets after a subdued fourth quarter. The modest bull run in recent weeks created a profitable opportunity for industry players, from major venues, including the likes of , to an array of retail-focused FX brokerages. This month, however, Refinitiv failed to capture volume rebounds and its FX products were flat to slightly lower month-on-month.

In particular, saw a total average daily volume (ADV) of its FX products coming in below $400 billion mark for the second month in a row. This total reflects trading volumes on financial data provider’s FXT platforms across all transaction types, including spot, forwards, swaps, options, and non-deliverable forwards.

FX volumes consolidate

December’s figure represents a minor drop of 0.8 percent month-over-month from $398.0 billion in November 2019. It has also failed to outpace the trading turnover from the same month a year ago, marking a -0.3 percent fall year-over-year from $396 billion in December 2018.

In a month in which major currencies made a strong comeback against the dollar, bolstered by hopes of Sino-US initial trade deal, average volumes for spot trading improved to $78 billion in December. This figure is up four percent from $75 billion in the month prior. On a year-on-year basis, spot turnover for December registered a -13 percent drop from $90 billion a year ago.

Following a bumpy period in geopolitics throughout 2019, the recent jump in volumes has been comparatively modest in relation to the first half. reflect the trend observed in the monthly figures from many of the major trading platforms. However, given its position as a major trading hub for the wholesale market, the company provides one of the most comprehensive snapshots of activity.

Be First to Comment