Grey Labels are a popular solution in emerging market countries as they provide a low-cost entry point, with more control over clients’ markups, spreads and leverage than a traditional IB relationship with a broker.

While the setup costs are traditionally low for Grey Label, the ongoing costs such as commissions, maintenance fees, and a lack of execution opportunities, become cost prohibitive.

Moreover, the transition from Grey label to White label is not always seamless, as certain technology providers make it more difficult to switch (clients) from a Grey Label to a White label.

In short, grey labels come with a host of for new brokers, which in our opinion tend to inhibit growth rather than help to accelerate it.

The Condor FX Pro platform solves the problem for companies seeking an end-to-end White Label / Branded FX business solution at a low-cost entry point.

The comes with a fully branded trading terminal, complete back-office with built in MAM and flexible access roles, web traders, mobile trader, and liquidity provider gateway.

Additional customization is also available for brokers via our experienced in-house software development team.

Charting

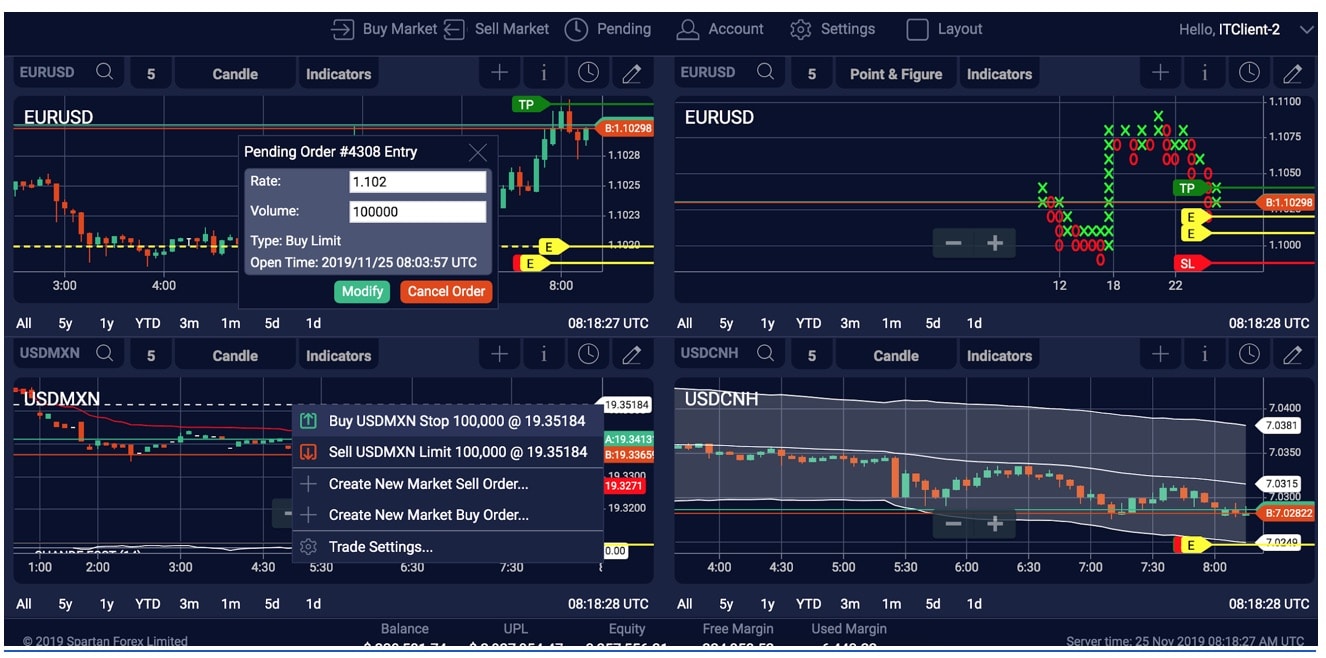

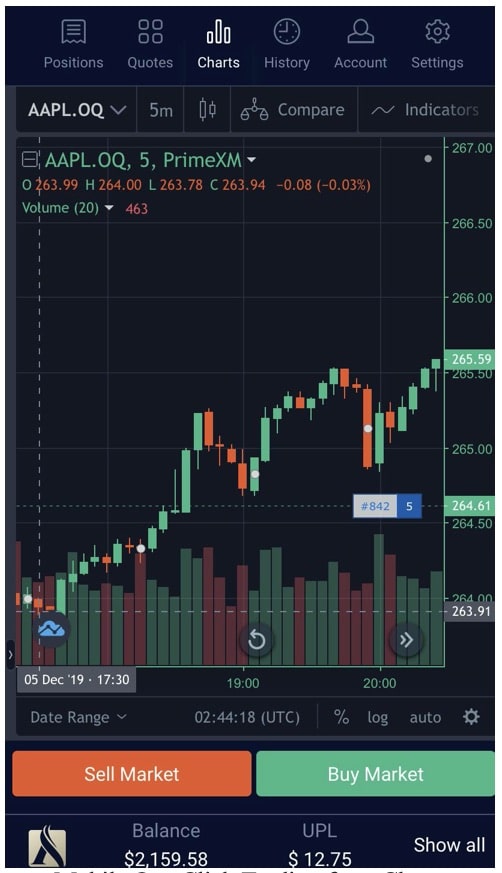

Condor FX Pro allows the trader to trade completely from the charts. In Condor’s Premium Webtrader, the trader can open trades by right clicking on the chart and then drag and drop the resting orders directly from the charts.

With trade sizing on the fly clients can automatically set the perfect entry and exit amounts based on their own risk parameters.

Condor has three charting packages (proprietary charting in the downloadable Trading Terminal, Trading View charts, the world’s most popular Crypto charting package, and premium charts with powered by ChartIQ as part of Condor’s Premium Webtrader offering.

Condor FX pro has integrated with PrimeXM’s XCore and OneZero’s Liquidity Hub, which provides access to over 200 liquidity providers.

For brokers or clients with existing technology and liquidity arrangements, Condor FX Pro can seamlessly integrate within 24 hours and supports multiple asset classes.

CONDOR IS ALREADY CONNECTED TO THE BRIDGES BROKERS CURRENTLY USE.

With Condor Back Office, brokers can easily manage markups, exchange style three-tier margining, liquidity source, and execution type (A book or B Book).

You can buy the Source code!

Condor FX Pro provides options to brokers to purchase the source code. Firms can buy the source code and then customize it for their own needs allowing brokers to build their intellectual property.

Condor FX Pro provides this at a fraction of the cost compared to other development companies.

Source Code Purchase

License to Purchase:

Custom & Steady State Software Development available

It is no secret that successful brokers such as FXCM, Plus500, and CMC Markets offer multiple platforms and intake over half of the flow on their PROPRIETARY technology.

As a result, at least half of trade flow is specific to their business – this increases customer loyalty and reduces customer churn.

Further, offering unique solutions to traders is a crucial point of differentiation when everyone else is offering the same.

Moreover, as a licensee or as an owner of source code, if you have unique and proprietary solutions for FX business, you can implement it on Condor FX Pro platform and be a game-changer and a leader in the market by offering a platform that nobody else has.

for a platform walk thru.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.

Be First to Comment