After such a strong appreciation, the price should correct as a consequence of profit booking. Which are the possibilities that follow?

Long-term perspective

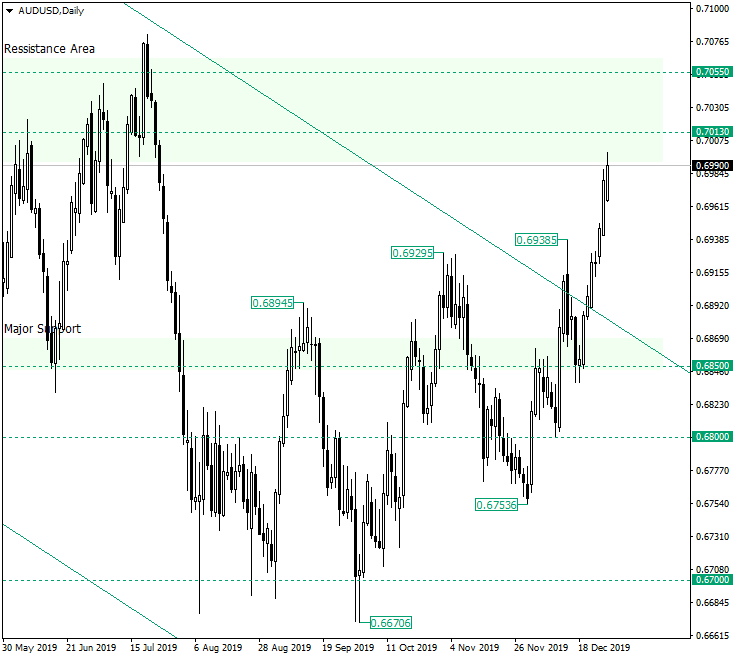

After it bottomed at the 0.6700 area, the price began an appreciation phase that let very little room for the bears to prove themselves. As pointed out by the price labels, the market printed more and more higher lows and higher highs, respectively, a clear characteristic of bullish dominance.

The bears had one last stance at the upper line of the descending channel. It looked very promising for them, as the line was falsely pierced and the price retraced to the major support of 0.6850.

But instead of passing beneath the level, the price confirmed it as support and began a new appreciation, one that pierced once more the resistance of the descending trend — this time for good — and extended until it almost reached the important area noted by 0.7013 and 0.7055, respectively.

In the current state of affairs, the bulls still have room to march towards the north. But, at a certain point, the profits that they gained — irrespective if are within the ones that bought from 0.6700 or along the appreciation that started after the confirmation of 0.6850 as support — must be booked, a decision that will trigger depreciation.

As the bulls eye 0.7055, it is expectable that the price will retrace after it arrives at that area. This retracement, on the other hand, will decide the course of events for the medium term as follows. If the depreciation is limited by 0.7013, then the appreciation may resume sooner. On the contrary, if 0.7013 does not manage to withstand, further decline could be seen. In this latter scenario, the 0.6900 psychological level — not highlighted on the chart — could be paid a visit, postponing further movement towards higher prices.

Short-term perspective

Starting from the 0.6746 area, the price is in an ascending phase. The last swing extended until 0.7003.

The appreciation can continue either after a consolidation pattern or after a corrective swing that will touch 0.6933 — and, of course, confirm it as support. If one of these two scenarios unfolds, then the target would be 0.7047.

If 0.6933 is not able to sustain further appreciation, then 0.6855 may very well serve as a bearish target, potentially threatening the long-term bullish scenario.

Levels to keep an eye on:

D1: 0.7055 0.7013

H4: 0.6933 0.7047 0.6855

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Be First to Comment