Over half (54%) of UK’s pet owners have not taken out an insurance policy for their animal. Despite the high levels of underinsurance, research from comparethemarket.com reveals that a large minority (44%) of owners would struggle to afford vet bills out of their own savings. The number is even higher for cats, where 62% are not covered compared to 47% for dogs. This equates to around 4 million uninsured dogs and 6 million uninsured cats living in the UK.

In spite of the widespread reluctance to insure their furry friends, eight in ten pet owners still have concerns about the safety of their pet. According to the research, the top three anxieties amongst pet owners are that their animal will be hurt in a road accident (43%), will be injured in a fight with another animal (41%), or will be stolen (30%).

44% said that they would struggle to afford vet bills out of their own savings

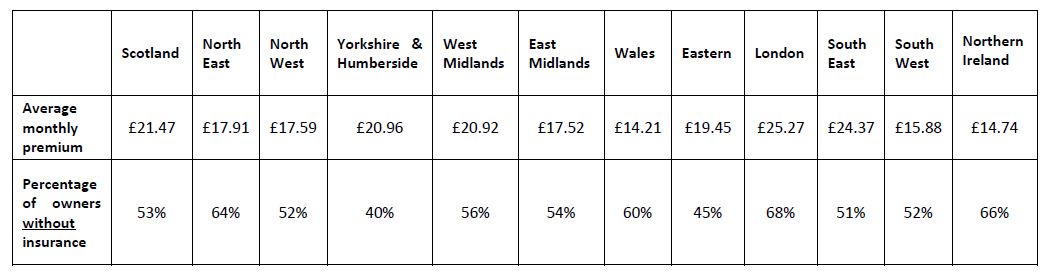

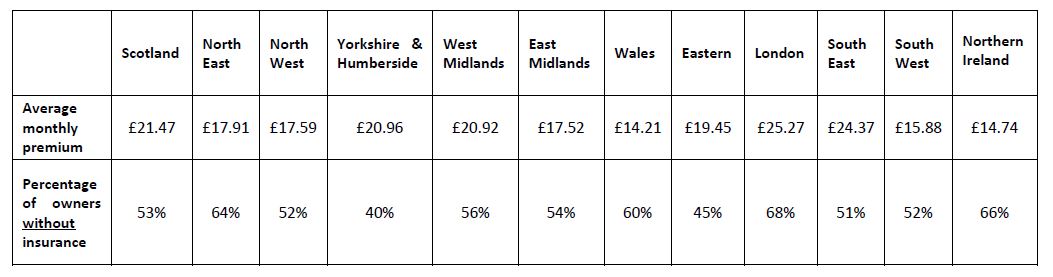

Of those who do have insurance, the average premium per month is £19 or around £230 a year, although this varies by region. Londoners pay the highest average monthly premiums (£25) but are least likely to insure their animals. By contrast, Yorkshire pet owners are most likely to have taken out a policy, and the Welsh pay the least per month (£14.21). Pet owners have different levels of concern depending on where they live. In urban areas, anxiety rises to 82%, compared to 76% in the countryside.

The majority of policy holders said they took out insurance in order to reduce the cost of vet fees (64%), over a third (35%) said they had a policy because they were worried their pet would fall ill, and a quarter (25%) feared their pet would be hurt in an accident.

Of the pet owners surveyed, nearly a third (32%) admitted that their cat or dog had been taken ill or injured and had to see a vet. Cuts and scratches were the most common reason for vet trips (23%), followed by injuries sustained as a result of a fight with another animals (23%), skin or paw problems (15%) and ear or eye conditions (13%). 7% of pets had tail problems and 8% were admitted to the vet because they had eaten something they shouldn’t have.

Andrew Milburn, Pet Expert at comparethemarket.com, said:

“It’s surprising to see that so many pet owners haven’t taken the steps to protect their pets, and their bank balances, should they get ill or injured. There’s no NHS for pets, and, if you don’t have pet insurance, vet fees can often come to hundreds or even thousands of pounds.

“Pet insurance doesn’t just cover the cost of looking after your pet if they fall ill or are in an accident. Our research suggests that owners are particularly worried that their pet will hurt or be hurt by another animal, but many insurance policies also include third party liability. This covers compensation and costs from accidental injury or damage caused by your mutt to another animal, person or property. By contrast, the law considers cats to be “free spirits” so their owners are not accountable for what they do. As with all insurance products, carefully check the terms and conditions to be absolutely sure what your policy covers.”

According to data from comparethemarket.com, the most popular dogs and cats in the UK and their corresponding monthly pet insurance premiums are asfollows:

Be First to Comment