Crypto custody for institutional investors has once again become top-of-mind for the cryptosphere following the United States Securities and Exchange Commission’s (SEC) October rejection of

Indeed, while there are far more viable options for cryptocurrency custody than there have been at times of previous rejections, SEC Chairman Jay Clayton still raised his concerns regarding crypto custody just weeks before the decision to reject the application was made.

Indeed, Clayton CNBC reporter Bob Pisani that while the crypto industry has come closer to satisfying the SEC’s concerns regarding custody, “there’s work left to be done.”

“How do we know that we can have custody and have a hold of these crypto assets? That’s a key question,” the Chairman asked.

Custody has always been a pain point for the industry–but are institutional investors using the viable custody options that are increasingly available?

Previously, in July, the SEC and FINRA delineating their concerns about crypto custody: “the ability of a broker-dealer to comply with aspects of the Customer Protection Rule is greatly facilitated by established laws and practices regarding the loss or theft of a security, that may not be available or effective in the case of certain digital assets,” the statement read.

And indeed, though the situation has improved, a lack of viable crypto custody options has historically been a major pain point for the industry when it comes to institutional adoption. Indeed, a number of analysts have argued that once the right custody solutions are available, a wave of institutional capital could come rushing into the cryptosphere

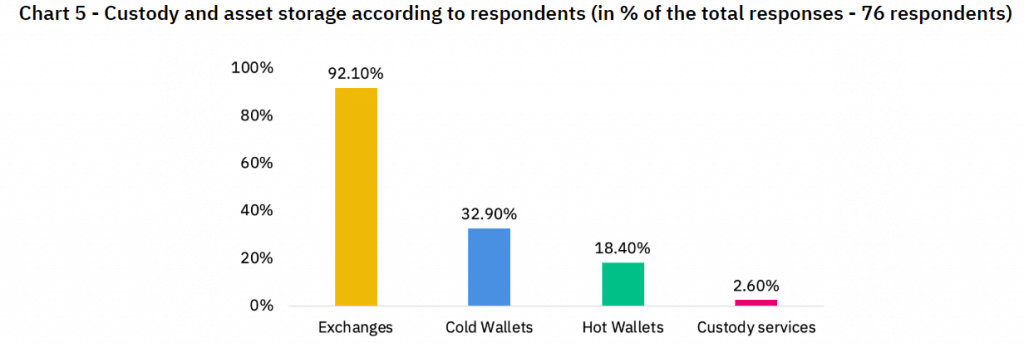

However, although things have improved since 2018 (the institutional crypto custody space now has well-renowned participants like Fidelity, Coinbase, and ICE’s Bakkt), that institutional investors don’t seem to be using these custody services; instead, 92% of the institutional investors that responded to Binance’s survey said that they prefer to keep their crypto exactly where most experts least recommend–on centralized exchanges.

Nice work to the entire team!

As a NY trust company, FDAS can provide execution and custody of crypto assets so institutional clients can buy, sell and transfer

Reminder that Fidelity has over $7 trillion+ in assets under its administration.

Onwards!

— Tom Shaughnessy🦉 (@Shaughnessy119)

The vast majority of institutional investors keep their crypto on exchanges and hardly use third-party custody services, Binance Research survey says

Binance surveyed “76 participants across our English & Mandarin surveys, primarily composed of firms, funds, and institutions with respective allocations to cryptoassets ranging from $100K to more than $25M.”

Interested in reading insights from institutional and large individuals on recent trends in the industry?

Discover their perspectives and profiles in Research’s latest report.

— Binance Research (@BinanceResearch)

The results of the survey are particularly surprising given the fact that storing funds on a centralized cryptocurrency exchange is widely considered to be the least-safest way to store crypto. Indeed, cryptocurrency that is stored on an exchange is vulnerable to attacks by hackers, technical failures, or–in some circumstances–mishandling by the exchange itself.

There have been many examples of this: to name a few more recent and more extreme examples, Japan-based crypto exchange Coincheck was hacked for $530 million last year; also in 2018, famously took the private keys to his exchange’s cold wallets with him to the grave. (Then, of course, there’s , , , and .)

Additionally, while most legitimate cryptocurrency exchanges have insurance or other kinds of contingency plans for restoring users’ lost funds should disaster strike, some do not–for example: most, if not all, QuadrigaCX users have yet to see a penny of what was lost to them.

So then–why do so many institutional investors seem to be leaving their funds at the mercy of centralized cryptocurrency exchanges?

Crypto’s “best practices” are still being built

Daniel Haudenschild, President of the Board of Directors at the Crypto Valley Association and CEO of SIBEX, a firm that creates new arbitrage opportunities for institutional traders, told Finance Magnates that while the survey’s results present “an impressive statistic,” it’s important to note that the results don’t take certain aspects of institutional crypto investing into account.

That being said, however, Haudenschild told Finance Magnates that the apparent custodial over-reliance by institutional investors who do use cryptocurrency exchanges directly is simply a sign of the times: a new market that still has yet to truly establish best practices.

“The fact that most institutional investors trust centralized exchanges is indicative of the immaturity of the market,” Haudenschild said. “High-net-worth individuals (HNWIs) are pushing their financial institutions for access to crypto against a backdrop of prolonged negative interest rates.”

Therefore, “few institutional investors have had the foresight to invest in the necessary infrastructure and talent to handle the demand. Many are now playing catch-up, using tactical interim steps to do so.”

But the consequences of this interim period could be severe. “Utilising centralized functions for storage is not recommended for crypto as it introduces significant unnecessary counterparty risk,” Haudenschild said. “This behavior shows clearly that many investors do not yet understand this market and struggle to identify the risk vectors and severity associated with digital assets. The learning curve will be steep as loss events take down entire ecosystems.”

”Most traders use cryptocurrency as a tool for profiting off of the price volatility, not for the underly properties of peer-to-peer trading.”

Kiara Bickers, author of Bitcoin Clarity: A Guide to Understanding, told Finance Magnates that the apparent reliance of institutional traders on cryptocurrency exchanges could simply be a marker of the kind of trading that institutions are engaged in within the space.

Indeed, Bickers said that the results of the survey were unsurprising “most traders use cryptocurrency as a tool for profiting off of the price volatility, not for the underly properties of peer-to-peer trading,” she said. “Traders can’t functionally trade if their funds aren’t on the exchange at all times.”

And it could very well be that that the kinds of institutional investors who are currently interested in Bitcoin and other kinds of crypto assets are not the type who would necessarily utilize third-party custodial services as long-term solutions: “institutional money already trades lots of bitcoin …. just not the type of institutions who are long term holders,” he wrote.

Institutional money already trades lots of bitcoin …. just not the type of institutions who are long term holders.

— Alex Krüger (@krugermacro)

“They place trust in their wealth and asset managers as they have for generations. Which is ok, until it isn’t.”

Therefore, it’s possible that the longer-term solution to crypto’s custody battle may be to improve custody on cryptocurrency exchanges, or to integrate third-party solutions into them. “I’d like to see exchanges publish more detailed reports on how they’re managing their cold storage….Right now there isn’t much consumer demand pressing for the knowledge on how their funds are being stored, but there should be,” Bickers said.

However, Haudenschild said that the current situation is that although “custody is often provided for ‘free’ with trading accounts,” trading platforms tend to “focus primarily on increasing trading volume, and secondarily on hack-proof custody.”

But the onus to solve crypto’s custody problem cannot be placed completely on cryptocurrency exchanges– at the very least, there are several different points at which various financial cultures must change their behavior.

“Now that investment into digital assets has grown beyond the early adopters and tech enthusiasts, in many cases the retail investors are driving the institutional investors. However, few HNW and Ultra high-net-worth individuals (UHNWI) individuals understand the space well enough to manage their own infrastructure,” Haudenshild said.

“They place trust in their wealth and asset managers as they have for generations. Which is ok, until it isn’t.”

Therefore, “it would be good if this statistic (92%) is an interim step,” he said. “One would hope institutions offering exposure are also taking the strategic steps to provide in-house custody.”

Haudenschild pointed out that providing in-house will require a serious culture change in asset management: “most financial services companies have been spending the last 10 years moving into a cloud architecture. Digital assets is one place where this trend is starting to reverse. Crypto is one area where companies should be maintaining their own in-house, on premise, custody solutions.”

”The most effective move centralized exchanges can make is to invest in decentralized solutions.”

However, the ultimate solution to crypto’s custody conundrum may eventually be to move away from the centralized model completely.

“Centralized exchanges, like brokers, are an interim step to market adoption,” Haudenschild said. “Centralized exchanges perpetuate a model with a fatal flaw; they need to grow to get liquidity, and the more they grow, the more they become more of a honeypot for hackers, and subsequently they become more of a target for regulators.”

“This not only increases the cost profile but it is also a model that is pockmarked with major loss events that can close out entire markets from crypto investments,” he continued. “The market is moving towards decentralized infrastructure and peer-to-peer trading. The most effective move centralized exchanges can make is

These would automatically place the responsibility of custody in the hands of the investor themself or of their appointed third-party custodian. While self-storage carries its own set of risks, even for institutional investors, the mantra rings true–

Not your keys, not your bitcoin.

Not your keys, not your bitcoin.

Not your keys, not your bitcoin.

Not your keys, not your bitcoin.

— Rhythm (@Rhythmtrader)

Be First to Comment