The Commodity Futures Trading Commission () has filed and settled enforcement actions against operators of Silverstar Live, who were marketing passive returns through their forex trading bot.

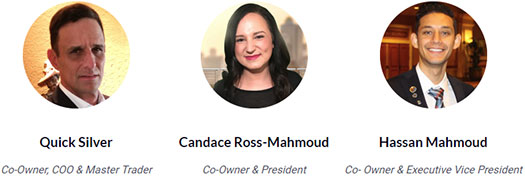

The US derivatives regulator hit Silver Star Live (SSL) and Silver Star Live Software LLC (SSLS) with penalties totaling $75,000. Two co-owners of Silverstar Live, who were ordered to pay the fine, were identified as Candace Ross-Mahmoud (President) and Hassan Mahmoud (Executive Vice President).

The settlement involves charges that from July 2018 to March 2019 the defendants fraudulently solicited to purchase their FX day-trading system by misrepresenting the software’s effectiveness. Defendants sold the ‘double your money’ software for $199 and then $145 a month to provide users with access to the auto trading bot and other personalized trading advice.

Specifically, the claims to bolster the credibility of their system included that the system aims for $250-600 a month profit for as little as $300 deposit, and falsely calmed their software relies on algorithms with a proven track record to make these purported profits.

Furthermore, in their solicitation materials, the defendants never included the hypothetical disclaimer required by CFTC regulations, which plainly states, “the results are based on simulated or hypothetical performance results that have certain inherent limitations.”

In addition to the false representations, in their respective Silverstar Live corporate bios, Hassan Mahmoud was credited as “an international Omnipreneur & Keynote Speaker who is highly sought out by the millennial community to work with and to work on passion projects all over the world.” He also claims to have done over 250 million in sales over the past 4 years while helping multiple business owners grow their names and brands.

The CFTC said the recent action should set a precedent for additional enterprises that fail to comply with the commission’s requirements. The case highlight regulators’ concerns about the risks posed by auto trading systems sold on the internet, which the watchdog says it has seen an increase in websites that fraudulently promote such products and its related advisory services.

Be First to Comment