Now that the cryptocurrency industry is maturing, competition between cryptocurrency exchanges and other kinds of virtual asset service providers (VASPs) is stiffer than it has ever been. A number of exchanges have even been forced to shutter their doors as a result of low trading volume.

Therefore, building a solid strategy for onboarding and retaining users is vital–while Bitcoin may still occasionally boom, the hype that brought hundreds of thousands of new users clambering into the space in late 2017 is unlikely to ever return.

Recently, Finance Magnates spoke to Kris Marszalek, CEO of the Hong Kong-based VASP ecosystem Crypto.com. The ecosystem includes an exchange app, an MCO Visa Card, and the Crypto.com Chain, a native blockchain that powers Crypto.com Pay. Crypto.com also recently launched Pay Your Friends, a crypto-based social payments app similar to Venmo.

We asked Marszalek how Crypto.com is , how volatility affects trading behavior, and what really matters when it comes to user metrics.

Building a ‘sticky’ product

When it comes to building a product or platform that users will be loyal to, “there’s always two things to think about here,” Marszalek said. “One is the user experience and how you design it–it needs to be really smooth and effortless. The second one is financial incentives.”

“We apply the same thinking to most of our products,” he continued, pointing to Pay Your Friends, an app built by Crypto.com that operates similarly to social payments app Venmo, but with cryptocurrency. “You’re going to get [up to 10 percent] cashback every time you pay someone back.” Users also get $50 rewards for signing up new friends to the platform.

“So there are some real financial incentives here,” Marszalek said.

Essentially, the key is to build a product and a brand that users feel emotionally connected to. If this is done successfully, “[users] become advocates for our brand and they onboard their friends, and we just try our best to continue to improve the products and give them more functionality without more complexity,” he explained, “so they more and more reasons to use [them] every day.”

“I think this approach–to just very practically improve your product–works extremely well in this space.”

Marszalek added that data plays an important role in this method of practical improvement. “Right now, as a company, we’ve got almost 200 people, and we’ve set up our entire organization to really use the data that we save from the users in our platform, and then roll out new ideas for product improvement very quickly.”

“What you end up having if you have this type of approach, where you look at user experience, design, and incentives–you get a very ‘sticky’ product [that encourages] people to stay in your ecosystem. They don’t churn as much as they would otherwise.”

“The vision is that you get to work on something that has the potential to impact the world and make it a little bit better. But in order to make it happen, you need to take care of all these nitty-gritty details…it’s not very glamorous, but it makes your product better every single day.”

“Generally, the entire space is guilty of not investing in user experience,” he said. “That’s what it comes down to.”

What really matters when it comes to user metrics?

So, how effective has this kind of onboarding strategy been for Crypto.com? “We just hit a milestone of one million users on the platform in September,” Marszalek said, three years after the company was founded in 2016. While a million is nothing to sniff at, it’s not much when compared to an app like Coinbase,

But Marszalek is undaunted: “these are complex products that we are building,” he said, pointing to the Crypto.com app that was released in May 2018. “We’re very happy..with the stickiness of the product.”

Indeed, Marszalek believes that this ‘stickiness’ factor is often overlooked when it comes to the ways that companies measure their success: “people tend to focus too much on ‘vanity metrics’ and not enough on what really matters. The stickiness of the product determines whether you’re going to be here in five years or not,” he said.

It’s your basic human right to control your money, data and identity.

— Kris | Crypto.com (@Kris_HK)

“People tend to throw out the biggest number that they can find–it might be that you have 5 million registered users, but some of them may have [signed on] in 2013 and already forgot about your brand three years ago.”

Marszalek says that if you really want to know how users are feeling about your platform, there’s a simple question you can ask them: “you can ask your customers ‘how would you feel if, starting tomorrow, you couldn’t use this product anymore?’ If [over forty percent] tells you that they would be extremely disappointed, you’re onto something.”

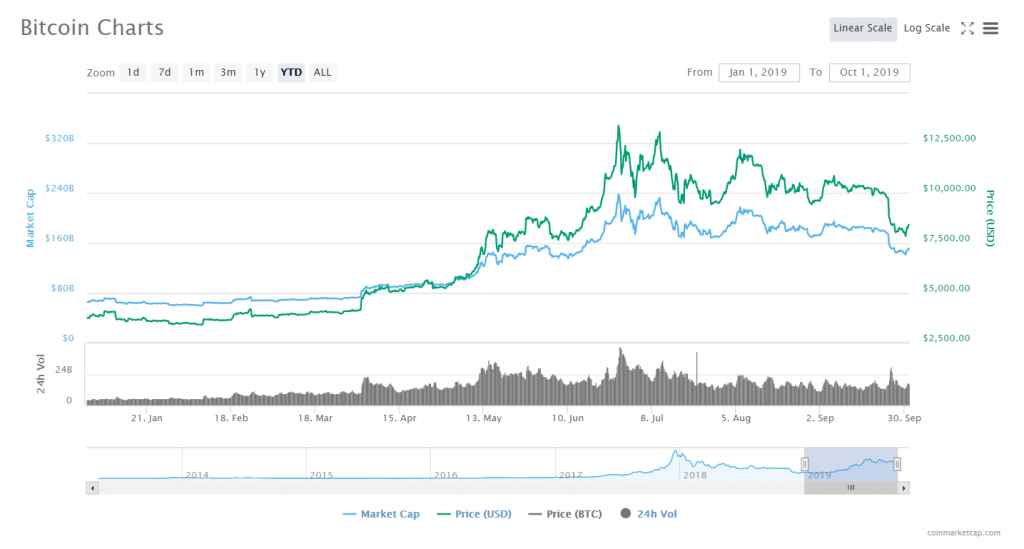

“[Volatility is] high right now because this market is still very small–the liquidity is low, even for Bitcoin itself.”

“Where the market is today is that more volatility equals more activity on the platform,” he said, “because for the vast majority of users today, this is a new investment class that they invest in to get a return. So, it’s quite counterintuitive–but for example, BTC dropped 20 percent last week. But for us as a platform on that day, we saw much more activity than on a regular day where the price goes up by two percent or something–that’s how it works.”

“We see patterns in behavior–like if [Bitcoin] drops, some people sell more, some people buy more, and when it goes up, then some people convert it to fiat and spend it on their card.”

“I think that the volatility[inherent to cryptocurrency markets] is a feature. It’s not a bug,” Marszalek said. “It’s high right now because this market is still very small–the liquidity is low, even for Bitcoin itself. You can move an entire market with $100 million.”

At the same time, however, “it has [been] proven time and time again that crypto can’t be killed. It will survive–no matter what kind of dropoffs we will have and whatnot, it will always bounce back. After Mt Gox collapsed in 2014, there was doom and gloom and [questions of] if cryptocurrency is going to survive. But after 2017, in the beginning of 2018 when prices started to drop, nobody ever questions that crypto is going to survive. It’s a completely different story.”

“It’s very important that people understand that this is just the phase we’re in. As the market matures and the infrastructure is built by companies like us and many others, and there are people solving problems in digital asset custody, and other people onboarding large financial institutions that will bring in more liquidity.

Additionally, there are “large customer brands like,” Marszalek said, adding that Apple is likely to follow sometime within the next two years.

Also, “slightly controversial, but good for the market in general–Facebook’s announcement about their cryptocurrency.”

“All these things will increase liquidity in the market, and with increased liquidity, volatility is going to reduce,” he said. “In the meantime, you’ve got the solution of stablecoins…so if someone doesn’t want the volatility, they don’t need it. They can just move to something stable.”

This was an excerpt. To hear the rest of Finance Magnates’ fascinating interview with Kris Marszalek, visit us on Soundcloud or Youtube.

Be First to Comment