The vast majority of the world’s cryptocurrency trading volume is in the hands of “lower quality exchanges”, while the world’s top-rated exchanges control only 5 percent of cryptocurrency trading volume, according to a from CryptoCompare.

In fact, the report claimed that in July, 54 percent of cryptocurrency trading volume belonged to exchanges that CryptoCompare gave a “D” or “E” rating to, while only grades “AA” (5 percent), “A” (19 percent), “B” (8 percent) , and “C” (4 percent) comprised the remaining 46 percent.

However, the report also says trading volume has shifted towards higher-volume exchanges since the month of July has passed: “in July, volume from the highest quality exchanges (AA and A) increased 29% and 10% respectively. Meanwhile, volume from E-rated exchanges (representing 142 billion USD) decreased by nearly 20% since the previous month.”

AA-Graded exchanges saw a 29% rise in total volume in July. These exchanges include – who top our Exchange Benchmark Ranking. Check out the full July Exchange Review here…

— CryptoCompare (@CryptoCompare)

Additionally, the report noted that aggregate changes in volume from June-July saw top-tier exchanges (rated “AA”, “A”, and “B”) increased 4.4 percent, while volume from lower-tier exchanges (rated “C”, “D”, “E”, and “F”) increased by just 0.7 percent.

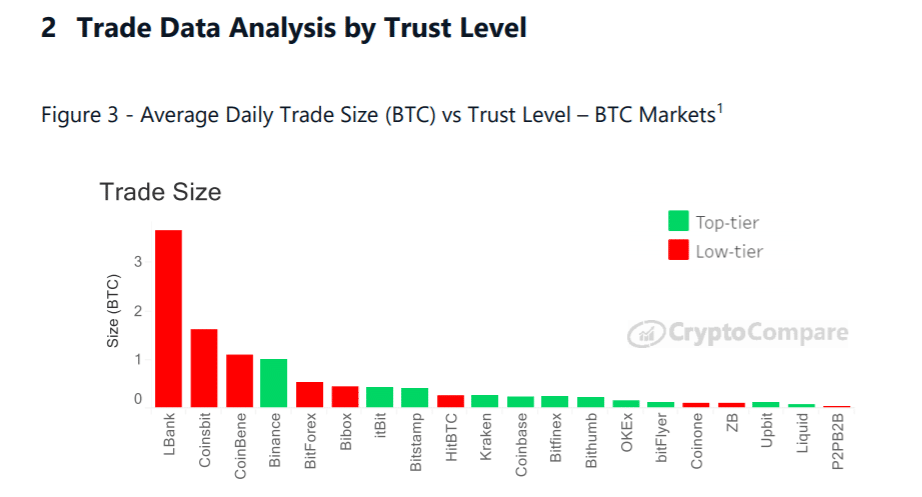

Lower-quality exchanges also had larger trade sizes

Despite this positive shift, CryptoCompare’s data also showed that three exchanges–LBank, Coinsbit, and CoinBene (respectively ranked “D”, “E”, and “E”)–had the highest individual trade sizes within their total trading volumes. LBank’s average trade size was 3.7 BTC, while Coinsbit and CoinBene each saw average trade sizes of 1.6 and 1.1 BTC.

Additionally, four exchanges in good standing–Liquid, Binance, OKEx, and BitFlyer (all of which received ratings from “AA”-”B”)–had the highest daily trade counts. Liquid reportedly handles over 400,000 trades each day, while Binance handles over 300,000.

CryptoCompare’s , known as the “CryptoCompare Exchange Benchmark”, includes geography, investments, team & company quality, data provision quality, legal & regulatory assessments, and other criteria in its evaluation.

Awareness around fake trading volume has increased

Controversy surrounding the trustworthiness of a number of cryptocurrency exchanges erupted earlier this year when Bitwise Asset Management accusing exchanges of propagating fake trading volume.

The report has contributed significantly to an and market manipulation within the cryptocurrency industry space.

Be First to Comment