Deutsche Bank is gearing up to cut hundreds of jobs in its equities trading and research, as well as derivatives trading, as part of a cost cutting drive, according to the Wall Street Journal.

Although formal numbers have yet to be announced, the German lender may eliminate as many as 15,000 to 20,000 jobs, joining a growing list of multiple jobs reduction rounds this year.

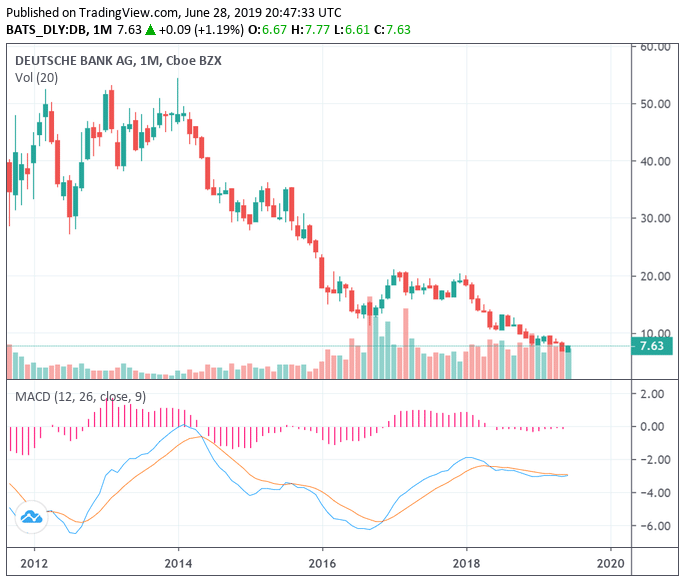

Job cuts could hit one out of every six full-time positions globally and may extend into 2020, the report said. Shares of the Deutsche Bank rose to a five week high on the heels of the report.

shares slid to fresh record lows last month as its CEO Christian Sewing announced sweeping job reductions across the firm following a fraught year of money laundering allegations, low interest rate environment, and lawsuits by Donald Trump.

The lender is shuffling around major executives

Germany’s biggest bank also faces pressure from investors to push ahead with further cost cuts this year and pull out of businesses where it isn’t profitable, especially after the collapse of .

The bank has also been shuffling around major executives in the last few months. A number of key executives have exited the bank, including for is Europe, Middle East and Africa (EMEA) business.

Deutsche Bank is the latest group to announce a in 2019 amid a difficult period for the world’s largest investment banks.

Earlier in May, HSBC Holdings Plc was reportedly preparing to ax hundreds of investment banking jobs amid falling trading revenues and the impact of EU regulations which continue to weigh on the sector.

The , which is conducting a cost-cutting drive aimed at protecting its dividend, would target 500 jobs within global banking and markets staff.

Be First to Comment