In the era of tight spreads and almost unified leverage across multiple jurisdictions, brokers are now starting to compete on a new level. In the case of Amana Capital, the firm designed its latest product to focus on a . The firm is today launching its brand new RiskPulse product together with a modernized website.

Amana Capital is the first retail broker to develop an in-house risk management tool for its customers. Today, the company is officially unveiling its RiskPulse smart risk analytics product alongside a new website, both designed to improve the trading experience of novice, experienced and professional traders alike.

The major product update together with the new website design are enriching the user experience with new features, a more modern look and access to the new suite of professional tools which Amana delivers to its customers.

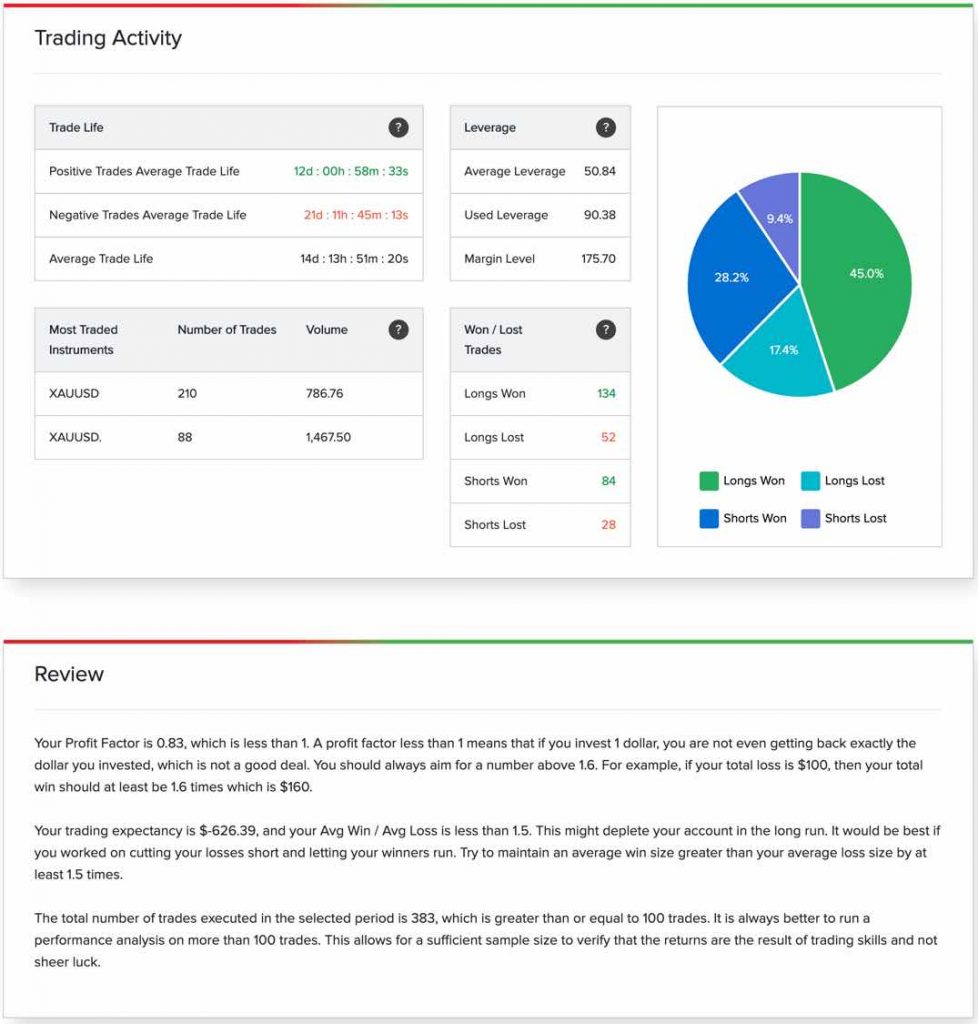

Based on a detailed analysis of a trader’s behavior patterns in the market, the RiskPulse software is delivering to clients of Amana Capital detailed guidance about the critical aspects of their behavior while trading different markets.

RiskPulse delivers an automated analysis of the trading performance of the client, helping understand and underscore strengths, weaknesses and risk-taking behavior patterns.

While there are several solutions on the market from third-party technology providers, Amana Capital is taking the lead in delivering a proprietary tool for risk analytics. Detailed information about a trader’s behavior and strategies are opening the doors to a new generation of retail traders that can address and mitigate pressure while trading the market.

The rise of AI and machine learning technologies enable brokers to deliver to clients advanced assistance tools that are providing deep insight into the well-known negative feedback loops. Consequently, as traders are getting a better understanding of what causes them to lose money, they can take adequate steps to mitigate their risk exposure.

Amana Capital is no stranger to innovative technology, with the group’s founders both coming from a quant background. The ultimate success story for both clients and brokers is when traders are doing in the markets so good, that they continue trading for long periods of time.

The longer a good trader sticks with the same brokerage, the more revenue from commissions he/she generates for the company. With both sides of the equation on the winning end, the relationship between broker and client is taken to the next level.

Commenting to Finance Magnates, the CEO of Amana Capital, Ahmad Khatib, said: “At a time when regulators are increasingly vigilant over the products offered to retail clients, we decided that empowering our customers with an advanced analytics tool that can help them analyze their trading behavior is the best thing we can do.”

“RiskPulse is not only providing our customers with a free risk analytics engine, but it is also signaling to them what are the strengths and weaknesses of their approach to trading the market,” elaborated Mr Khatib.

Be First to Comment