The market has long been predicting the demise of MetaTrader 4, despite the rock-standing domination of the trading platform over the retail forex space. Closing on 15 years since the product has been released, it remains the industry standard offering, especially for brokers that are aiming to address the needs of algo traders.

Add to that the fact, that the company which developed the software also released a successor called MetaTrader 5 in 2010. Eight years have now passed without the new platform being able to surpass the dominance of MT4.

The Hard Data

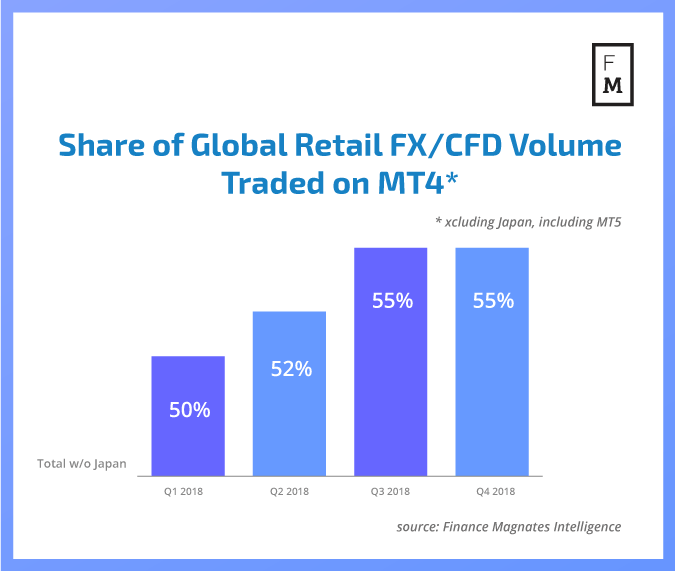

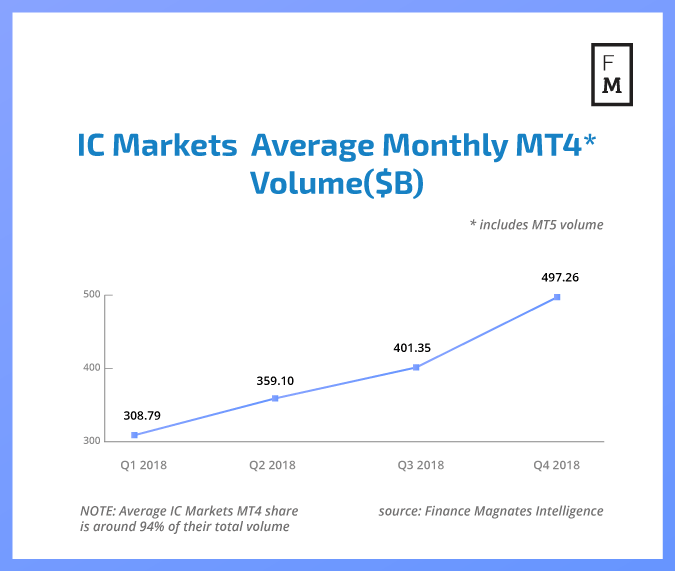

Over 2018, the Finance Magnates Intelligence department collected a dataset which sheds light on the continuing importance of MetaTrader 4 for the retail forex brokerage industry. Our first chart below details the amounts of volumes brokers are transacting via the MT4 platform across the global retail broker industry outside of Japan.

Until the end of the year, that market share has reached as high as 55%. The increase in the market share of MT4 has been steady throughout the year, reaching a peak at the end of the 3rd quarter.

Did ESMA Cause MetaTrader 4’s Rennaisance?

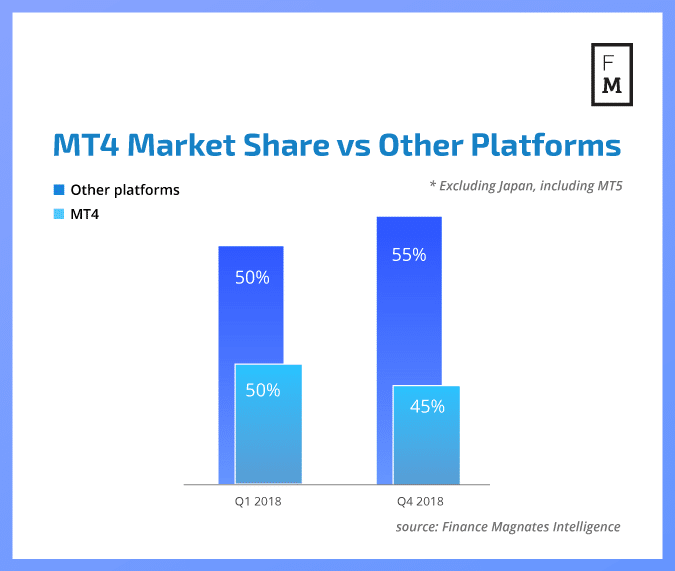

Data from publicly-traded companies are pointing to a sharp impact from the ESMA changes. The likelihood that clients shifted to brokers outside of the EU, which are more MT4-centric is confirmed from the chart below.

There is little doubt that this sharp rise is related to the harsh regulatory changes in Europe. Australian brokers have lately been actively pursuing licensing in the EU to take advantage of their strong growth and join the race to accommodate the needs of European customers.

The latest companies from the land down under to acquire a CySEC license are , and .

Be First to Comment