The US stock markets are enjoying a relatively bullish run, with marginal gains in 2019. The S&P 500 index is hovering around 2,775, the NASDAQ at 7,472, and the Dow Jones Industrial Average at 25,883.

At these levels, investors have reason to be concerned about a potential downturn in equities performance. The US economy is at ‘frontier levels’, and this presents a dilemma to some. On the one hand, investors could adopt the position that the current level is a base level and further growth is expected.

On the other hand, the bears among us believe that we have reached multi-decade highs and there is an inevitable downturn on the horizon.

The biggest sectors in the US economy include real estate, leasing and rentals, state and local government enterprise, finance and insurance, healthcare and social care, durable manufacturing, retail trade, wholesale trade, nondurable manufacturing, federal government, and information.

Insurance trade and surplus financial services amounted to $40.8 billion in surplus. 26.6% of the Fortune’s Global 500 companies have now located their HQs to the United States. These are staggering statistics, and they attest to the economic strength of the US.

US Banks by Market Capitalization

The (measured in January 2018) include the following top 5 enterprises:

Other top 10 US banks include Goldman Sachs Group at $99.38 billion, US Bancorp at $93.5 billion, American Express company at $87.46 billion, Charles Schwab at $75.19 billion, and PNC Financial at $73.38 billion. Combined, the market capitalization of the top 10 US banks exceeds $1.76 trillion.

At the end of 2017, the size of the US economy was $19.39 trillion, and by 2018 it was expected to reach $20.41 trillion. Clearly, the banking industry and financial services is an integral component of the economy at approximately 5% – 10% of aggregate GDP.

Why Are Bank Stocks Performing Sub-Optimally?

2019 Performance (Year-To-Date)

2019 bank performance figures are ostensibly bullish and belie the performance of bank stocks since quantitative tightening kicked in several years ago. In fact, if we extrapolate over the course of 1 year, the aforementioned Morgan Stanley (MS) is trading significantly lower than it was in February 20, 2018 ($55.10).

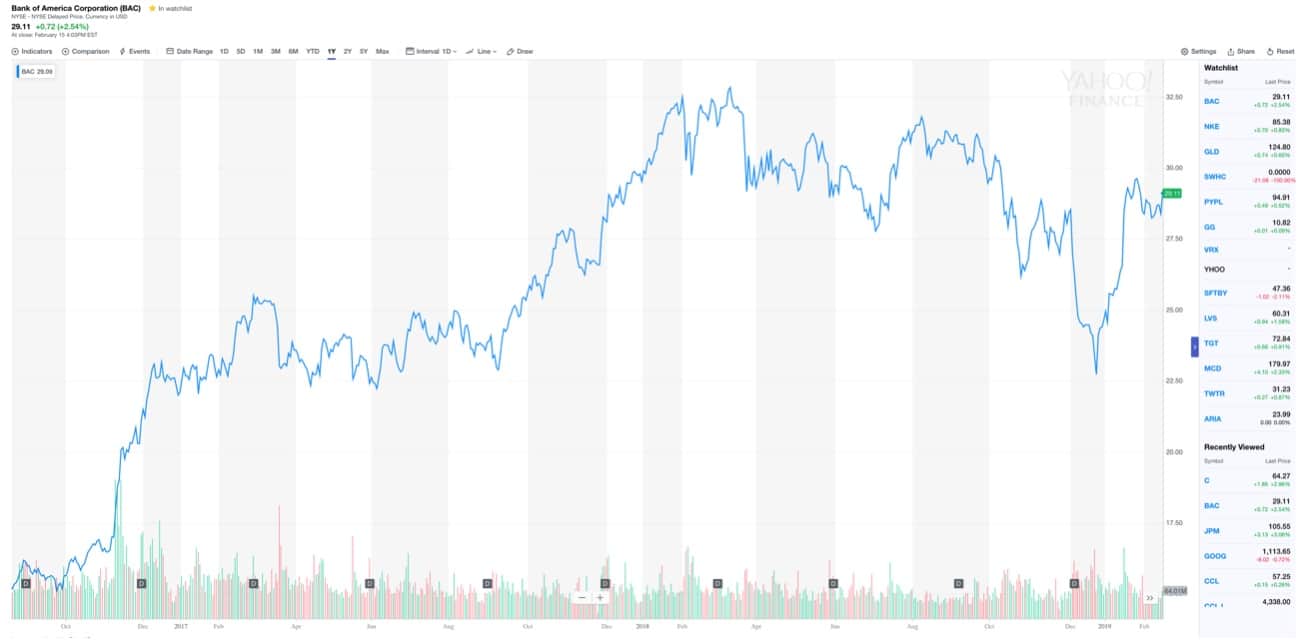

Much the same is true of Citigroup Inc (C) which was trading at $77 per share a year ago. Likewise, (BAC) was trading at $31.24 per share a year ago.

Given the extrapolated performance of bank stocks, deregulation, quantitative tightening (interest-rate hikes), and a booming US economy do not seem to be having the desired effect on bank stocks. There are several possible reasons why these hot stocks have cooled over the past 1 year, notably:

According to the Federal Deposit Insurance Corporation (FDIC), several important industry trends are evident in the US economy:

Brokerages Attempt to Smooth Volatility of Investing in Financial Stocks

The leading brokerages routinely offer long-term investment management advice on various ETFs, including bank stocks. Through a combination of innovative trading technology, automatic rebalancing activity, and dividend reinvestment, it is possible to harness market behaviour and generate positive returns based on an overarching evaluation of the financial markets.

Leading authorities like Bertrand Badre (former chief financial officer of the World Bank) and Jeff Carney (CEO of IGM Financial) have spearheaded various initiatives to help investors derive maximum yield.

One such initiative which has come under the spotlight in recent years is Wealthsimple, co-founded by Brett Huneycutt and Michael Katchen.

Casual investors typically do not adhere to important activities like portfolio rebalancing, which has a significant impact on the success of one’s portfolio. The darlings of yesteryear may become the bugbears of today if a portfolio is not readjusted to reflect changing market preferences.

For example, when bank stocks are booming, portfolio adjustments should take place to allow the investor to increase exposure to this industry, while reducing exposure to other sectors which may be performing sub-optimally.

revealed some interesting takeaways. For example, the app is quick to download and install and it instantly connects investors with the global financial markets. Many investment brokerages focus on building powerful platforms that are difficult to navigate.

Wealthsimple offers a broad-based set of solutions for investors, including graphing, charts, technical and fundamental analysis.

All of these resources are needed to evaluate the performance of the underlying securities. The interactive nature of the Wealthsimple app allows investors to understand the intricacies of the financial markets in a powerful and easy-to-navigate platform.

Investors simply deposit funds and the management system takes care of the funds allocation to different investment vehicles. Plus, this investment firm is led by a team of highly qualified directors and investment advisory committee members acting on behalf of investors to derive maximum yield.

Few brokerages today offer exposure to the brightest minds in the industry. This brings tremendous insight to the investment arena and allows for much more stability in investment decision-making practices.

While nobody can eradicate the volatility inherent in equities markets, it is always preferable to invest alongside industry-leading experts who have the collective experience to assist where necessary.

Based on current trends, interest rates are set to rise modestly in 2019, which should propel bank stocks in the process.

Disclaimer: This is a contributed article and should not be taken as investment advice

Be First to Comment