Group has released a comprehensive for the one-month period ending on January 31, 2019, detailing average spreads and slippage metrics on its ‘Active Trader’ trading accounts.

Slippage is the difference between the quoted prices and those at which the client’s orders have been executed by the broker. The less slippage the trader gets, the better his trading results will be.

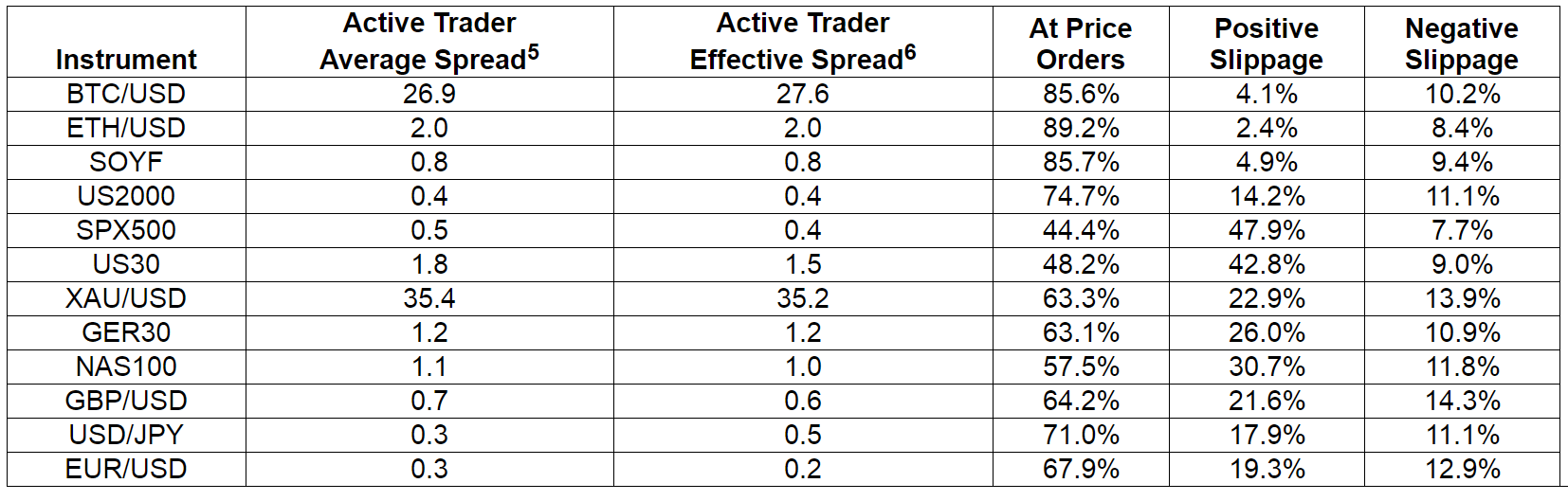

According to figures stated in the report, the average spreads on the EUR/USD, USD/JPY, GBP/USD and XAU/USD pairs were 0.3, 0.3, 0.7 and 35.4 pips respectively. For the cryptocurrency pairs, the company averaged 26.9 pips on BTC/USD and 2.0 on the Ethereum instrument, ETH/USD.

has recently expanded its range of cryptocurrency instruments and now offers CFDs on the second most popular coin, Ethereum, for all of its trading accounts.

The introduced the new asset type earlier last year when it began testing the service with its already installed Bitcoin offering.

Slippage Metrics

has also advertised its price improvements/slippage statics during January 2019, which showed the following highlights.

• 11.46% of all stop, limit, ‘at market’, and entry orders received negative slippage

• 67.70% of all limit and limit entry orders received positive slippage

• 45.35% of all stop and stop entry orders received negative slippage

Additionally, the online brokerage has disclosed its Effective Spread statics, which displays its quoted spread for its top FX pairs, and compares the figures with actual spreads, at which trades were already filled, with the difference being displayed in a table key.

The following table shows the exact figures in January:

Commenting on the findings, Brendan Callan, CEO of FXCM Group, said: “During the month of January FXCM expanded its crypto CFD offering adding Ethereum. FXCM’s spread on Bitcoin remains to be extremely competitive with Bitcoin orders executing at price or better 89.7% of the time during the month of January.”

Be First to Comment