Planning an exit strategy for your FX brokerage is an important consideration, and one that certainly crosses an entrepreneur’s mind as their business grows and evolves.

Given that we currently seem to be in somewhat of a consolidation wave across the industry, this topic has been a popular one behind closed doors, as well as in the media.

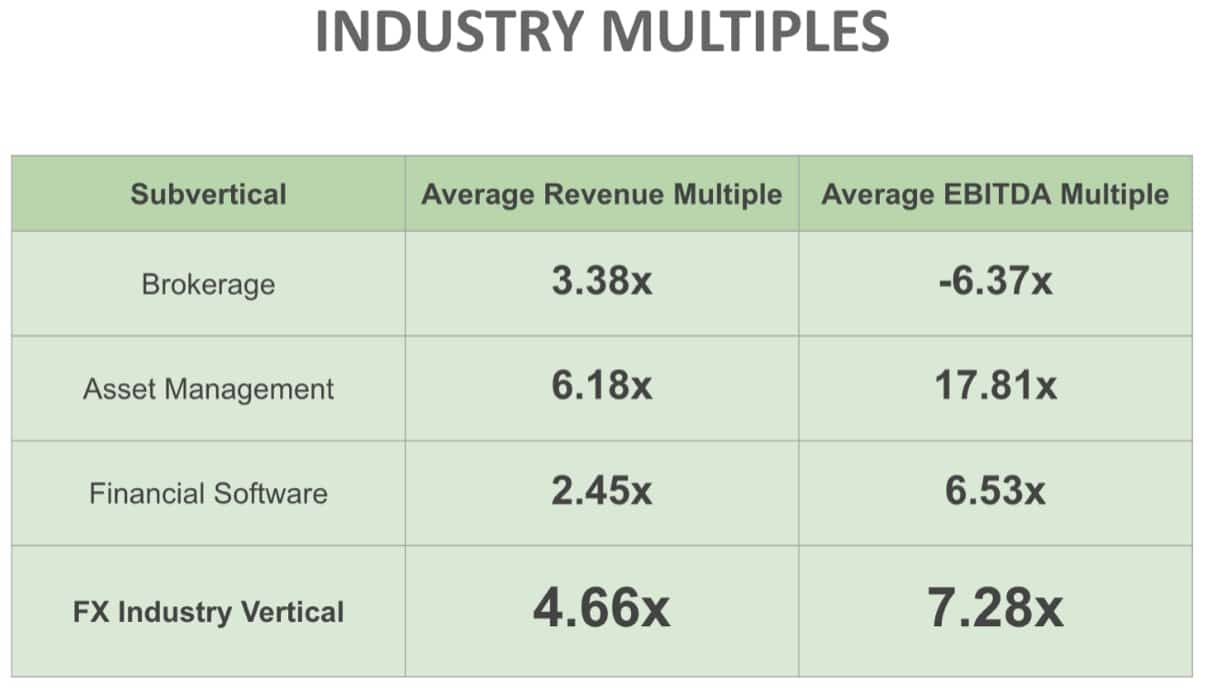

Generally, compared to the software industry where we are looking at average multiples of 21-25 times EBIDTA, M&A transactions in the retail FX broker space are showing multiples of 5-10 times EBIDTA at most for the best deals we have seen recently.

Why is there such a dichotomy?

There are many reasons such as a product business versus a service business, the high risks associated with running a brokerage business, especially market risk, and the general lack of intellectual property amongst many others.

For these reasons, traditional Venture Capital and Private Equity firms do not have much appetite for such investments given the combination of high risk and low return multiples.

As a result, FX firms should be looking towards partnering with strategic buyer, typically the larger FX brokerage conglomerates or players from the industry’s vertical.

So, how would you make your brokerage more attractive to a potential buyer?

M&A activity in the FX sector in 2019

M&A activity in the sector is estimated to intensify in the coming year and there are a few driving forces behind this. Regulation is the main one that gives impetus to industry consolidation.

ESMA enforcing new leverage rules on CFDs, MiFID 2 and Chinese tightening of fiscal policies are all putting pressure on companies operating in FX brokerage sector, by increasing compliance and overhead costs and pushing revenues down, a situation that has been already reported by major players.

According to Demetris Tsingis, Managing partner at FinCap Advisors, only 70% of M&A activity in the FX space is being reported. Deals that are valued below 3-5 mln USD are typically being kept private and that is why it is hard to assess real trends and multiples as most of the transactions are not visible to the general public.

However, what we do know, is that such activities are taking place at an accelerated pace in 2019.

Reasons for intensified M&A activity in the FX sector

2018 was the year that saw significant deals take place in the market, most of them being reported on the institutional side but some, like the OneFinancial acquisition by AxiCorp, were announced to the wider audience.

Overall, firms are looking to improve their efficiencies, expand globally to diversify their client base, and larger firms are looking to obtain regulatory licenses in different jurisdictions with less restrictions or that have a well-established framework for FX regulation.

One such example is increased interest in the AFSL license in Australia, one that commands significant premium due to looser leverage restrictions unlike the current rules in the EU.

For the past decade in FX, regulation and risk management have been the biggest worries for the industry’s executives as frameworks around the world were evolving and maturing.

It appears that this process is far from completion and will remain to be a determining factor in the fate of FX firms.

While the industry remains extremely lucrative, with average profit margins at 29% (compare that to airline industry with less than 1% profit margins!), it comes with greater risks that many investors may not be willing, or able, to tolerate.

But if owners invest extra into reducing operational risks, implementing solid risk management strategies and adding some proprietary technology, to guard against the above, then value will be created for all stakeholders involved.

If you have any questions, or would like to discuss any of the above, feel free to contact me at .

Learn more about common approaches to valuation and typical approaches in FX space – Download the for free.

Be First to Comment