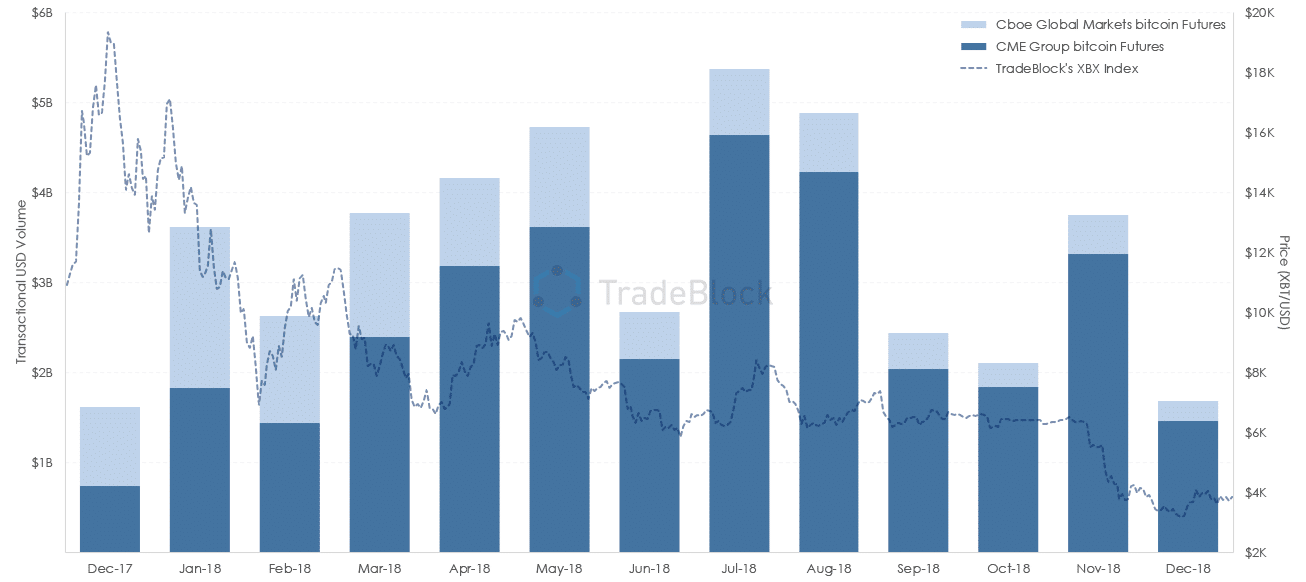

“Crypto winter” has the hit the crypto futures market as the trade volume across the futures contracts market plummeted drastically in the second half of 2018.

As revealed by a Tradeblock report, the total bitcoin futures trading volume across Chicago Mercantile Exchange (CME) and (CBOE) has declined and reached near parity with spot trading volume of five US-based crypto exchanges – Coinbase, Itbit, Kraken, Bitstamp, and Gemini.

Both CME and CBOE launched the Bitcoin futures instrument in December 2017 which boosted the value of Bitcoin to touch its peak. However, within a month, the spot market started to correct itself with a year-long bearish run and has lost 70 percent of its volume compared to mid-January 2018 numbers.

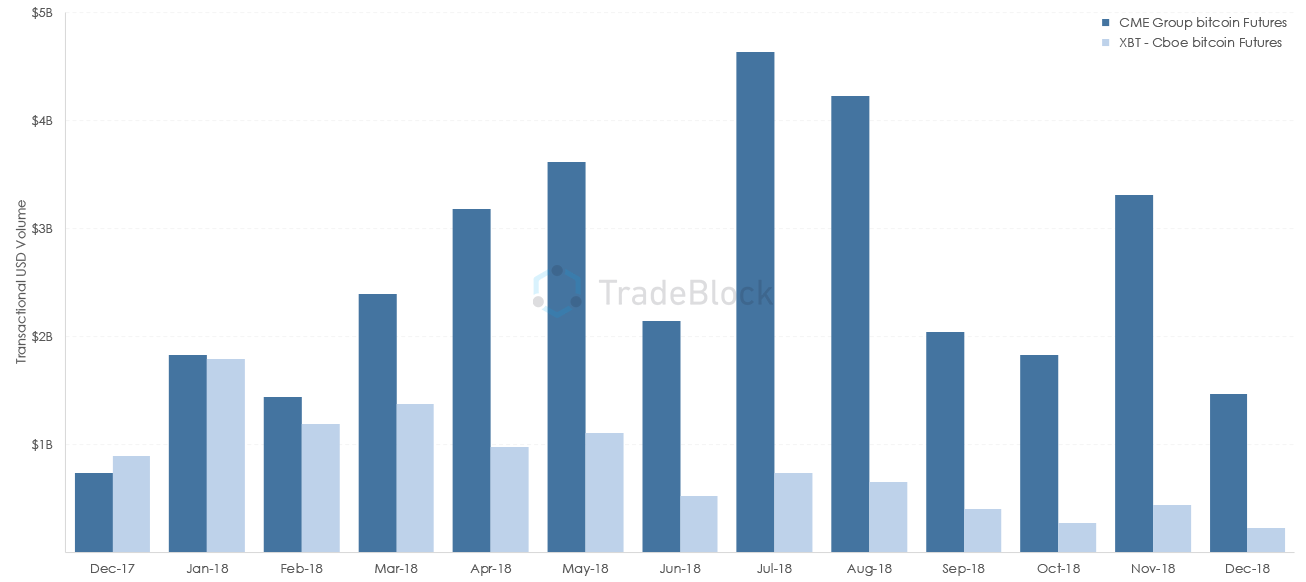

Tradeblock’s analysis shows that the futures market reached its peak in July and August 2018, however, the market took a downturn since then.

Moreover, among the two competitors, CBOE has lost significant market share to its rival CME as the later continued to dominate the market within a couple of months after the launch of the instrument. Tradeblock, however, did not explain the reason behind CME’s market dominance.

Tradeblock pointed out that December 2018 registered the lowest monthly trading activity in BTC futures since the inception of the investment products.

“These findings highlight that futures trading activity has declined significantly since reaching a peak in the Summer of 2018. Spot trading activity, similarly, has declined considerably,” Tradeblock noted.

Despite the slowdown in the BTC futures market, major players like , Nasdaq, ErisX, and CoinFLEX are planning to enter the market in 2019.

“It will be interesting to see how these trends change, as the market prepares to launch several new bitcoin futures platforms,” Tradeblock added.

Be First to Comment