One trend has been clear in the aftermath of the introduction of the new ESMA rules last August. In their drive to look for new clients, a large number of brokers introduced a “prime of prime” offering.

I am not going to get into the details how many of those “prime” branded offerings are actually prime of prime and how many aren’t. Instead, I’m going to focus on a trigger which might have been largely overlooked by the industry last month.

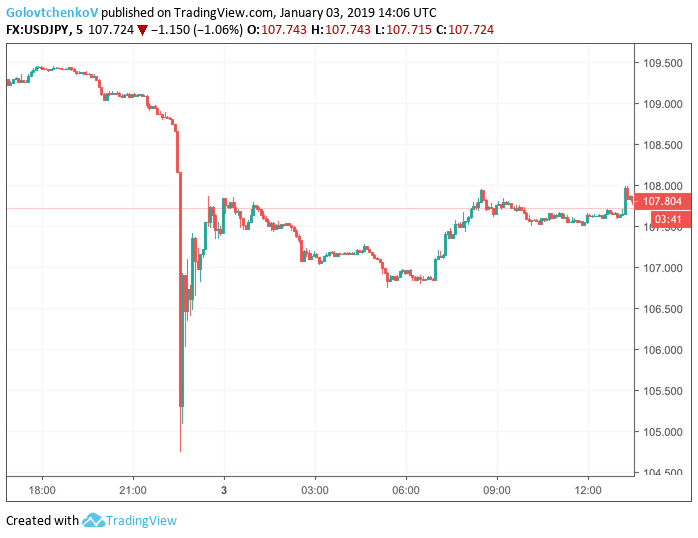

I am speaking about the first major trading day of the year, the 3rd of January. After a benign start to the year on the first official trading day, early New Zealand hours on the next day. Starting from Japanese yen pairs, the move rolled over to antipodean currencies such as the AUD and the NZD, ultimately causing a lot of confusion.

As we found out last week, some negative balances from the event. In a similar way to 4 years ago, when the SNB flash crash wracked havoc, STP brokers got hit by the lack of capital of their clients.

Unexpected Events are Still Lurking

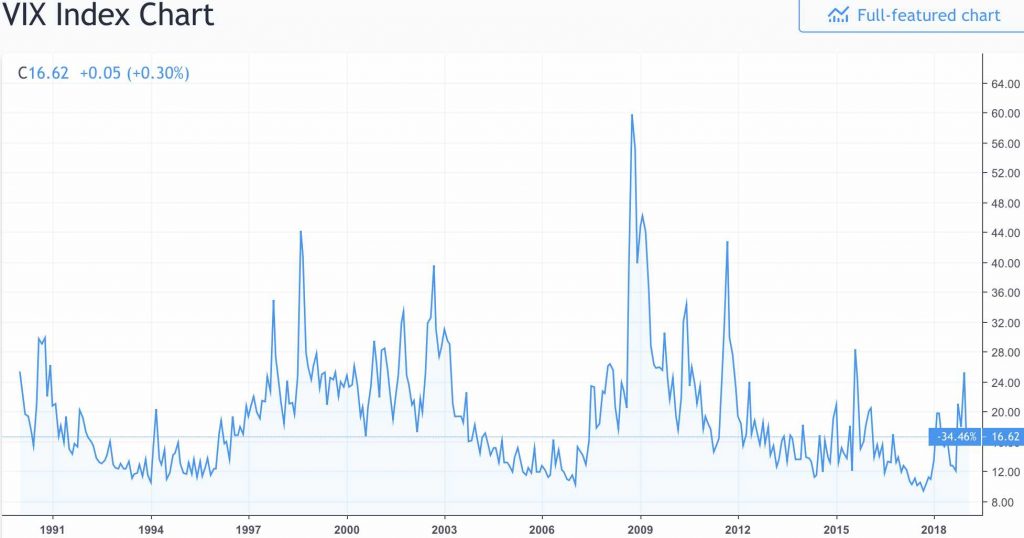

In contrast to the , the US, French and Italian elections, sharp moves in the FX market happen when an unexpected event occurs. Brokers are well prepared for times of high volatility, but realistically, have no effective way to anticipate when such an event might happen.

January’s flash crash across JPY pairs provided refreshing evidence that market risks are inherently unpredictable. Ever since the Global Financial Crisis of 2008, pockets of thin liquidity are quickly bursting in front of our eyes leaving us unable to react quickly.

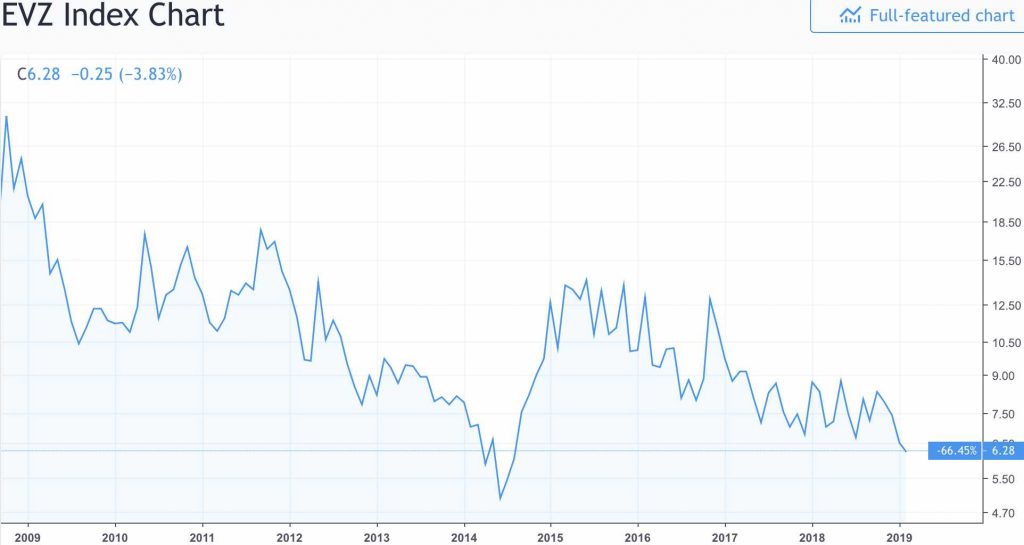

Risk-averse options traders are thriving in such markets, in contrast, spot FX punters can be quite disturbed by those. The ability of trading algorithms to detect and anticipate such events is present, but only at a highly sophisticated level. When it comes to companies that are used to be on the right side of the market, the situation is different.

Broker Preparedness

Despite the historical fact that retail clients are usually on the wrong end of a trade, the risks of running a book are lurking around the corner. Sophisticated risk-management is sometimes that main differentiator between true prime of primes and unreliable counterparts.

Brokers have been dealing with the issue of having enough reliable counterparts for quite some time. The JPY event in January clearly exposed the structural weakness of the FX market provided that some conditions are met.

Thin markets and ill-prepared liquidity providers can cause a significant loss of money and trust on part of clients. The temptation of getting cheaper liquidity can be the difference between filling your clients and getting them into negative equity.

Volatility Signals

Also, back in 2008, while the industry was still young, the bulk of trading activity on part of customers was focused on FX. Fast forward 10 years and many brokers are relying much more on income from customers that are trading indices. Just think about all that extra income you got from the unexpected bout of stocks volatility in December.

My goal with this article is merely to stress the importance of risk controls at a time when the industry is healing from the post-SNB regulatory backlash. Let’s not forget what events led to ESMA’s actions and steer clear of more unforgivable mistakes. Looking after shareholder interests is not enough today, it is time for the retail brokerage industry to become client-centric.

Be First to Comment