We may look back to 2018 as marking a watershed year for FX brokers. Spurred by industry regulation and aimed primarily at protecting the retail investor, the market environment has altered both in scope and relevance on the supply side.

Overwhelmingly, brokers agree that greater market transparency, relevant and timely information, liquidity, depth and best execution are extremely important for clients and the broader industry.

However, despite this seemingly universal stance, only a small number of participants in the FX field have actually adopted tangible measures. Amongst this small group of brokers choosing to embrace these new regulations is .

Tier1FX believes that regulatory change is necessary if the industry is to remain relevant and it had previously instituted tangible dealing and administrative measures towards bettering the quality of its client offering.

This represents an ongoing process of its professional commitment towardsmore transparency within its business, while evidencing a strengthening of rules to better protect its clients’ investments.

The extent to which Tier1FX marks itself apart from the rest of the field is evident from a comparison with its key competitors’ business models or OM’s.

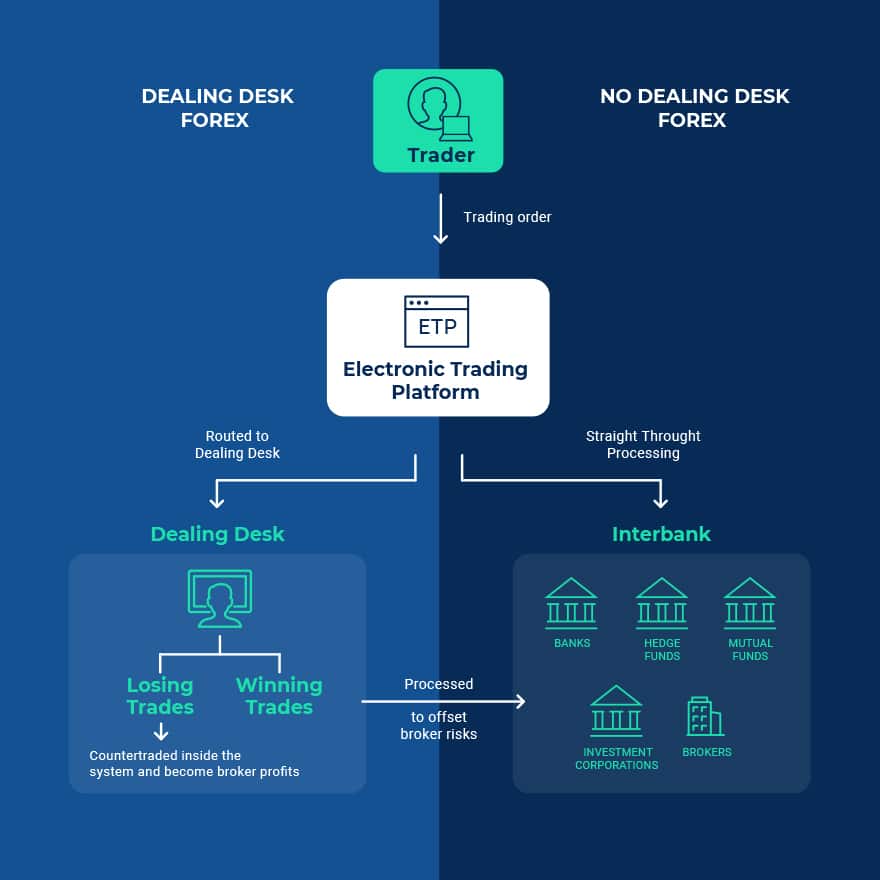

Dealing Desk

Dealing Desk (DD) brokers are commonly known as market makers or B-book brokers are liquidity providers who create a market for their clients to trade on. The market maker essentially acts as the wholesalers by buying and selling financial instruments as counterparty to other traders.

The market is populated with price quotes which are representative of the underlying market. These quotes are transmitted to the client via an electronic platform or voice medium. When the trader accepts a quote and places the order, the trade is executed with the market maker as the counterparty.

The ability however of the DD broker to identify a potential price action and the temptation to profit from it, may raise concerns about its professional impartiality. This should not read as a criticism of B-bookers generally, but the issues surrounding any alleged manipulation of prices quotes are inevitable especially during short bursts of price activity, volatility and other event driven moves.

No Dealing Desk

In comparison, no dealing desk (NDD) or direct market access (DMA) brokers provide access directly to the interbank market without passing orders through a dealing desk; therefore, removing any alleged conflict of interest and affording the trader with a better trading venue with access to deeper liquidity pools, variable spreads (never fixed), larger tradeable volumes and more competitive trading costs.

This should moreover reflect greater market transparency, improved and faster fills and, very importantly, trader anonymity.

An NDD broker generates its revenue by either charging a separate commission on trades or embedding the commission into the spread. The NDD brokers comprise of two types; straight through processing (STP) and Electronic Communications Network (ECN).

STP FX brokers send orders directly from clients to their liquidity providers (LPs) via an electronic platform. The LPs comprise rated financial institutions that provide wholesale brokerage services to eligible counterparties; Tier 1FX is an STP broker.

“The more liquidity providers we have the deeper the liquidity pool and hence the prospect for better execution. Our clients can trade larger market sizes without worrying about price slippage or outright rejection,” explained Sadek Baksh, Head of Global Business Development at Tier1FX.

An ECN, also referred to as an alternative trading system, allows all participants’ orders to be cross-matched directly without a ‘middle man’; therefore, traders become the counterparties to each other. Participants of an ECN can be individuals, banks, brokers and other financial institutions. Since the trades are settled directly, consequently, the cost is reduced. However, it does not mean a better price is always guaranteed.

What benefits exist for trading with NDD brokers?

The type of broker a trader will use is determined by their specific needs; there are pros and cons to each broker type.

Traders have suggested that trading with a NDD broker has allowed them to take advantage of superior fills, especially for larger trade sizes, and lower latency. This may be a result of NDD brokers investing greatly on the technology side, such co-locating and integrating directly with their LPs within advanced data centers.

Of note, , ensuring minimal latency and improved execution across its venue. The process largely eliminates the often detrimental trading consequences,arising from system freezing, requotes, slippage, lower market depths and slower executions.

According to Mr. Baksh, “The client should feel confident with their broker and trust them to provide the best trading environment possible. Tier1FX has built its reputation on putting the client first because without them, we will have no business.”

Moving forward

Generally, a successful and importantly sustainable business model is a reflection of client satisfaction. This reflects Tier1FX’s ethos that the trader needs be confident in their chosen broker, that there is every incentive to ensure the trader succeeds and does so consistently, and to dispel any concerns a trader may have to the contrary.

Tier1FX has identified with this as the necessary precursor to the growth of market acceptance and reputation within the global foreign exchange marketplace.

As an STP broker with a largely sustainable and growing client equity, Tier1FX identifies itself as the embodiment of change and of the future of the industry.

About Tier1FX

Tier1FX is a specialist provider of prime liquidity, trading and technology solutions; The group’s reputation is built on a foundation of trust, reliability and transparency. Tier1FX offers a pure and dependable DMA-STP trading venue, with no dealer intervention, where clients can trade with confidence, security and speed.

Be First to Comment