The cryptocurrency bear market has had a wide variance of effects on companies in the cryptocurrency industry. Some companies have thrived off of the trimming of the market; others have found themselves devastated by their suddenly empty coffers.

As a result, things are changing–fast. Companies are turning themselves upside down to keep up with the changes in the market: cutting back, scaling up, structuring, restructuring–oi vey.

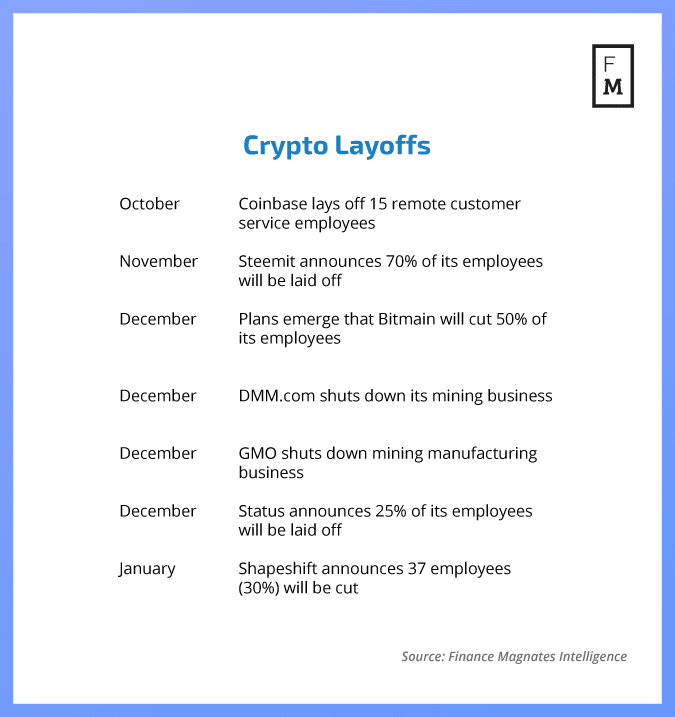

While not all of the news has been bad, reports of massive layoffs have run rampant through the industry.

Exactly what is happening, and why?

A Time of Churning & Overturning– A Time to ”Streamline”

That word–streamline–has echoed across industry layoff announcements.

Its first high-profile appearance came in ’ decision to lay off some of its customer service employees this October–a couple of months before industry layoffs could be described as a “trend.”

Indeed, Coinbase’ layoffs were seemingly far less severe than those we have seen in other corners of the industry; their use of the word “streamline” may actually be appropriate. While the company would not confirm a headcount of sacrificed employees, sources told Yahoo Finance that it was more than 15 people who worked remotely.

“We’ve learned that certain teams who are co-located are more efficient, effective, and happier in their roles,” the company said in an announcement explaining the layoffs. “So moving forward, some teams—including Support, Fraud, and Compliance—will only hire employees into Coinbase offices.”

“People here are pretty upset about it, and so far senior leadership is handling communications poorly,” a source told the publication.

While 15 employees may seem like pittance at Coinbase’ 550-person operation, the fact that the company may be preparing to go public has made all of the company’s actions points of possible scrutiny.

Investors have also been paying close attention to the comings and goings of Coinbase’ executive pool–no cuts or layoffs appear to have happened there, although the company did lose around the time of the layoffs.

ConsenSys: “The Fyre Festival of Companies”?

Jonathan Solomon, CEO of Bitcoin ATM and point-of-sale network DigitalMint.io, said that in addtion to Coinbase, some of .

Solomon explained that were caused by an all-too-common cycle of events in the cryptocurrency industry: botched funding and capital management.

Consensys, which is an Ethereum-focused incubator for startups and blockchain tech conglomerate, “did not have a clear revenue model and was self-funded by its founder from proceeds of a bull market,” he said. “Now that crypto asset prices have leveled out, that sort of growth was unsustainable and the founder could no longer self-fund.”

“ConsenSys is basically the Fyre Festival of companies” 👀

— Jeff Scott (@jeffscottward)

The consequences of this mismanagement are slated to be severe. On December 6th, CoinDesk reported that Consensys had plans to layoff 13 percent of its employees in an effort to “restructure” the company. CEO Joseph Lubin told the publication that the layoffs were an attempt to

Then, on December 20th, technology news outlet The Verge reported that the company was “quickly spinning out startups that it previously supported.” The spin-outs, as well as other cutbacks, will reportedly lead to the cutting of 50 to 60 percent of its 1200-person workforce.

The company sought to soften the blow in a , saying that “Projects spinning out is a separate concept than ‘layoffs,’ and the process of spinning out for ConsenSys spokes will occur in stages as each spoke is on a unique journey.”

“ConsenSys will shift from incubating projects internally to collaborating with external partners of all kinds: collaborators, builders, joint ventures, investors. From hackers to enterprises to governments,” the post said, diplomatically.

It seems, however, that ConsenSys isn’t fooling anyone. Even before the layoffs were announced, a Forbes report entitled “Joe Lubin’s Ethereum Experiment Is A Mess. How Long Will He Prop It Up?” estimated that the company’s annual burn rate is $100 million.

Shapeshift Shifts Down

Smaller, more agile companies have also felt the burn of the bear market.

Cryptocurrency exchange Shapeshift that it would be laying off 37 employees, approximately one-third of its staff. CEO Erik Vorhees wrote in the post that the cutbacks were “a deep and painful reduction, mirrored across many crypto companies in this latest bear market cycle.”

What was unusual about the announcement is that Vorhees seems to have gracefully come out and said exactly what everyone else has been finding ways to skirt around.

Among other concessions, Vorhees admitted that the company had “grown too fast, given our (in)experience as leaders. By the time we learned how to manage a 10-person team, we were 30. By the time we learned how to manage 30, we were 80. Then 100. Then 125. Our understanding of how to organize people grew, but not as fast as the people.”

The Crypto Market Crash Has Devastated Companies Who Stored Capital in Coins

Vorhees also cited the fact that the company kept too large a portion of its assets in cryptocurrency. “As a company, our greatest and worst financial decision is the same: to embrace substantial exposure to crypto assets,” he wrote. “Much of our balance sheet is comprised of them.”

Bill Sinclair, CTO and Interim President and CEO of crypto lending company SALT Lending, explained that this is an unfortunately common problem. “In many cases, companies in the industry have decided to hold large portions of their reserves in crypto. Any company that has approached their business in this way has likely lost resources as a result of the bear market,” he said.

“Companies Must Be Strategic and Somewhat Conservative When It Comes to Treasury Managment”

Volatility in cryptocurrency prices was also cited as the reason behind Ethereum-based chat startup Status’ decision to lay off 25 percent of its workforce. In a announcing the layoffs, co-founder Jarrad Hope wrote that “we budgeted based on an assumption of a higher floor in the event of a market crash, and did not prepare for scenarios where the value dropped beyond 80% since August.”

“Currently 25% of our roles are non-essential to those goals and our long-term growth projects, and regretfully we’re forced to ask the contributors occupying them to leave today,” he explained. That 25 percent represented about 25 people.

Similarly, blockchain startup Steemit cut 70 percent of its employees in November, citing the bear market.

“While we were building out our team over the last many months we have been relying on projections of basically a higher bottom for the market and since that’s no longer there, we’ve been forced to lay off more than 70 percent of our organization and begin a restructuring,” Steemit CEO and Founder Ned Scott said in a announcing the layoffs.

“The next 12 months we will be in survival mode from a cost-cutting perspective. We’re focused on building ad revenue for the first time on the platform, and getting operation fees under control” ~ new CEO

— Mike Dudas (@mdudas)

The Mining Industry

Perhaps no corner of the industry has been.

Chinese mining giant near the end of December, followed by rumours that the company has plans to eventually lay off roughly 50 percent of its approximately 2000 employees. The rumours were never denied by the company.

⚠️⚠️⚠️

there’s post on Chinese Linkedin (usually very high accuracy, posted by employees themselves) saying Bitmain will start a layoff the coming week … 😳😳😳

A separate rumor said the plan is for more than 50% of its headcount ???!

— Dovey Wan 🦖 (@DoveyWan)

Around the same time, Japan-based electronic commerce and Internet company ; GMO, the Tokyo-based holding company of GMO Internet Group, on its mining equipment manufacturing business around the same time.

What This Means: How is the Industry Changing?

Despite the growing number of layoffs in the industry, things may not be as bad as they seem. In mid-December, report revealed that blockchain developer positions were the most rapidly growing new job opening in the United States.

Similarly, reports have also emerged that certain pockets of the cryptocurrency industry have been thriving in the bear market– for example, . SALT Lending’s Bill Sinclair said that “what we’re seeing, especially within our own company, is the ability to create roles that are variations of positions in existing fields.”

Blockchain Companies Are Poaching Staffers With More “Traditional” Skill Sets

“Companies in the blockchain space are creating roles that leverage traditional skill sets,” he explained, “so we see a lot of potential for job growth as blockchain technology continues to evolve and become a larger part of our economy and a technology used by more traditional firms.”

Digital Mint’s Jonathan Solomon also sees major growth in his corner of the industry. “There seem to be a lot of opportunities for companies building infrastructure around leading cryptocurrencies such as Bitcoin,” he explained. “Online exchanges, crypto point-of-sale solutions, kiosks (), and other financial products are thriving and teams are hiring to build and support this infrastructure.”

What this may suggest is that the industry is changing more than it is shrinking–and that companies with certain qualities are feeling the burn far more than others. “The impact on the industry at large will be felt hardest for moonshot ‘pie-in-the-sky’ blockchain projects that aren’t currently generating any revenues, i.e. companies who haven’t yet established product-market fit within their customer bases,” Solomon said.

“Companies that have established traction, customers, and revenue will be less affected by the current crypto-market, while those companies that have not previously been revenue-focused will feel layoffs the most.”

Is the Party Over?

And indeed, the companies who have felt the layoffs the most have received the lion’s share of the media’s attention. Perhaps this is why–for some–the cryptocurrency market has passed the point of no return.

“Anyone working in crypto right now is like a tulip bulb salesman in the Netherlands circa 1637,” he said. “The party’s over.”

Be First to Comment