Japan’s plans to introduce its own cryptocurrency, which will have parity with the Japanese yen and will be used to make payments and transfers through a mobile phone app.

As Nikkei reported, the yet-to-be-named coin will be rolled out to retail shops and regional banks. It will enable standard transactions, such as shopping or transfer of money between individuals, at much lower costs as compared to credit cards.

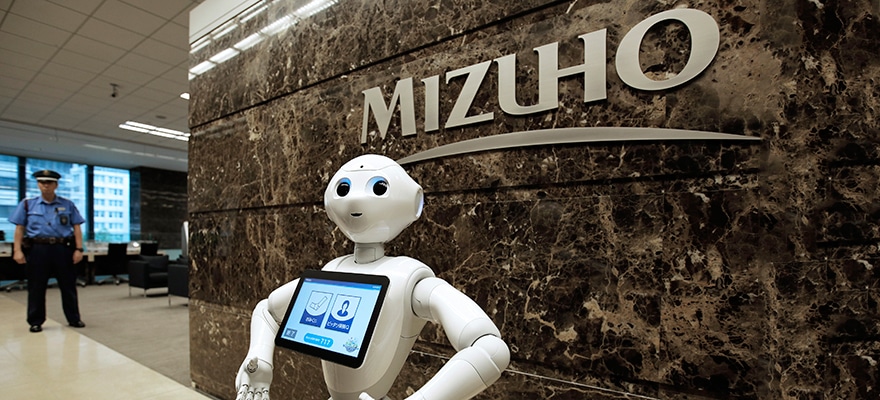

Scheduled to go live in March 2019, Mizuho’s coin would be convertible into yen on a one-to-one basis, operating via a smartphone app and using QR codes to be scanned in stores.

Users and retail shops will not be charged a fee on the cryptocurrency transactions, including transferring funds between their smartphones and bank accounts or sending funds to other users or the shops’ corporate bank accounts.

In return for providing the service for free, the banks would benefit by collecting more data on consumer spending patterns.

Japanese banks already onto crypto bandwagon

The Japanese financial services group has been exploring the digital currency space for the past few years. The latest initiative itself is the result of the J-Coin project, which was launched through a consortium of banks in 2017, and won support from Japan’s central bank and financial regulator to be ready for the 2020 Tokyo Olympics.

Mizuho also has a particular interest in blockchain technology. Last year, it completed a via a blockchain, which involved sending information from Japan to Australia with key financial data.

Japanese banks have increasingly moved towards developing their own cryptocurrencies or adopting the underlying technology to streamline operations and wean the Japanese off their heavy dependency on cash. For example, Japan’s biggest lender, Mitsubishi UFJ Financial Group (MUFG) announced earlier this year plans to test a , which promises to create a borderless shopping experience.

Japan’s Mizuho to Release Its Own Cryptocurrency in March

More from AnalysysMore posts in Analysys »

Be First to Comment