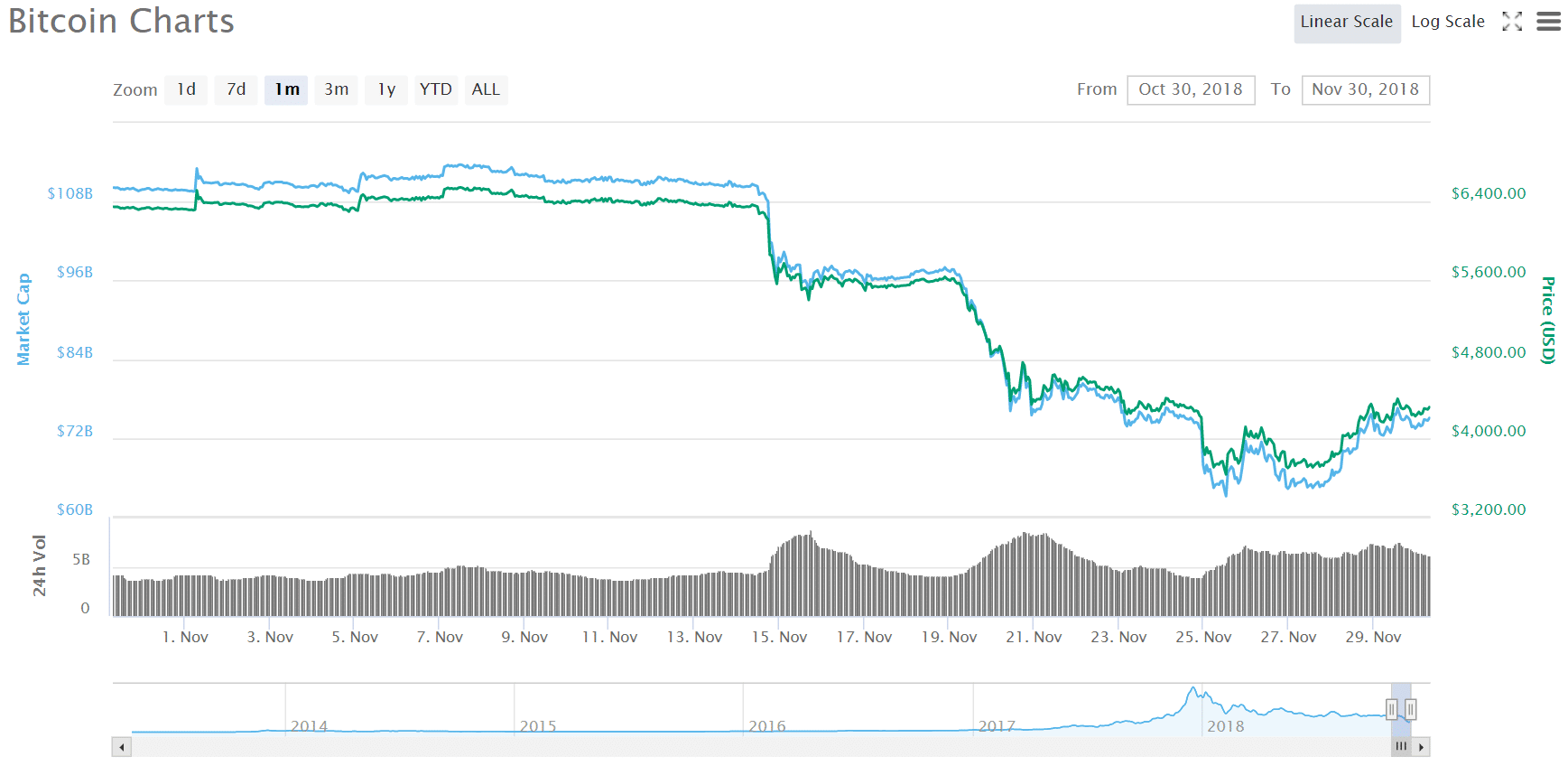

Over the last month, cryptocurrency markets have seen a veritable bloodbath. Riding comfortably at $210 billion for quite some time, the total market capitalization dropped as low as $118 billion earlier this month. At the time of writing, the markets had eaked back to $140 billion–an improvement, but still aeons away from where market capitalization was at the start of November.

Similarly, the price of Bitcoin fell to heart-breakingly-low rates this month, briefly bottoming out around $3700.

Much of the crash was blamed on the , which caused a massive split in the cryptocurrency community and reportedly caused a number of Bitcoin “whales” to sell off their BTC in order to support the Bitcoin Cash network of their choice. However, it is very difficult to quantify the exact effects that the schism had on the markets at large.

What happened? Why are cryptocurrency markets suffering so deeply now, almost exactly one year after the total market capitalization of all cryptocurrencies surpassed a trillion dollars?

And–perhaps more importantly–will things improve?

”Cryptocurrencies Have a Very Bleak Future”

There are plenty of analysts who say that actually, no, they will not–at least, not anytime soon.

One of them is Robert R. Johnson, PhD, CFA, CAIA, and Professor of Finance at Heider College of Business, Creighton University.

Johnson explained that he put the word ‘investors’ in quotations because “investors aren’t typically committing funds to bitcoin.” Instead, “speculators are,” he wrote. Johnson believes that these speculators are the reason that the cryptocurrency markets went up in the first place.

Cryptocurrency Prices Were Largely Driven By Speculation

“There is nothing to support bitcoin except the hope that you will be able to sell it to someone for more than you paid for it. There is no store-of-value aspect to a cryptocurrency. It is misnamed as it really isn’t a currency.”

“Speculators… rely on the – that is, that some greater fool will come along and pay you more than your purchase price. Perhaps that is why bitcoin enthusiasts utilize the tools of technical analysis to analyze the bitcoin market — you can’t employ fundamental analysis,” he said.

”Crypto Utility Has Taken Too Long to Mature”

Drew Farnsworth, host of the Good Data podcast, believes that the market crash is largely due to a failure to make cryptocurrency more practical and accessible in a timely manner. “Crypto utility has taken too long to mature and smart people have wised up,” he told Finance Magnates.

“Once the industry matures as a payment method (which will require reduced volatility) everyone hopes that there will be a virtuous cycle of increased investment and decreased volatility,” he continued, although it’s impossible to say when cryptocurrency could be adopted as a practically used payment method.

Crypto Markets Could Have Been “Puffed Up” By ICO Token Dumpers

Principal Consultant at Rocky Mountain Technical Marketing Jeff Stollman believes that instead of speculators, the price of Bitcoin and other cryptocurrencies was “puffed up because of widespread use by (1) organized crime, (2) terrorists, and (3) wealthy people in countries with strong export controls on wealth such as China.”

“With the increased enforcement of KYC/AML and the , much of this demand for ICOs, and crypto currencies more generally, began to dry up,” Stollman explained. “People laundering money did not want to identify themselves as is required to comply with KYC/AML. And with countries banning ICOs, these vehicles for moving money dried up…Once this large source of demand was removed from the market, the only way for the market to adjust was for crypto prices to fall.”

Indeed, it was theorized earlier this year that the massive fall in the price of was due to the widespread distribution and subsequent sell-off of ICO tokens months after the ICO boom of late 2017.

So which–if any–of the cryptocurrencies that became popular throughout 2017 and 2018 will survive long-term?

It’s Easier to Pick Losers

Only time will tell. According to Johnson, famed investor Warren Buffett once compared the cryptocurrency markets to the automotive industry in the first half of the 20th century, when there were hundreds of automotive companies; “now, there are only three.”

“In the context of that presentation, Mr. Buffett made the point that picking winners is very difficult, if not impossible, in rapidly emerging technologies. Picking losers is easier. He said the right play during the rise of automobiles in this country would have been to go short horses, had there been a way to do that.”

Johnson also quoted Warren Buffett in his belief that the only way to profit from cryptocurrencies would be “to short the whole basket of cryptocurrencies over a five-year period.” Then, “the results would probably be quite good.”

According to Jeff Stollman, the major difference between the cryptocurrency industry and other famous industry crashes, like the automotive industry and the , is that “Because dotcom companies built physical assets, the world benefited from their investments. As a prime example, we ended up with lots of fiber to enable high-speed communications that became available at prices below the cost of deploying it,” he said.

However, “in the crypto space, there are no assets who vestiges are reusable. If a crypto goes to zero, it leaves no trace.”

Things Won’t Bottom Out Until Next Year, Says Willy Woo

Johnson’s bearish views of the cryptocurrency market echo those of many other analysts in the academic and Wall Street spheres. However, voices from within the crypto community are also ringing the death knell of cryptocurrencies; or at least, a temporary death knell.

One of these is analysts is Willy Woo, a renowned analyst and researcher. Using a number of algorithms that have successfully predicted events in the cryptocurrency markets in the past,–after this point, Woo claims that things will start to improve.

So 30% think the bottom is in, 40% think more bear, and 30% are undecided.

People asked what I think. To me nothing has really changed, apart from some sideways nail biting.

I’ll repeat with updates…

— Willy Woo (@woonomic)

And of course, there are plenty of voices within the crypto community who continue to sing the praises of Bitcoin and other cryptocurrencies, perhaps in an attempt for damage-control; although the optimism of even some of the most prominent Bitcoin bulls is beginning to fade. Several weeks ago, Bitcoin Bull said that Bitcoin wouldn’t surpass $9000 by the end of this year.

By the way things are shaping up now, well, he wasn’t exactly wrong…

Signs of the Times

So far, the crash has had some very tangible effects on various aspects of the cryptocurrency industry. Last week, reports emerged that cryptocurrency miners in China were selling their leftover mining equipment “”

However, this mining equipment sell-off could be a good thing. Farnsworth, who has also worked in designing crypto-mining operations, told Finance Magnates that “hopefully the reduction in mining will reduce speculation and help to mitigate volatility.”

“Consolidation is bad for the security of the mining network, which could cause additional market anxiety and trigger additional sell-offs,” he continued. “If hash-rates go down then the little miners will get back into mining.”

However, the sell-off hasn’t been severe enough to produce any kind of heavy results. “Current conditions do not represent a significant decrease overall,” Siemer said.

In any case, Boss Cole (founder of Crypto Boss) does not see anyone attempting to exit the market at this moment in time coming out unscathed. “Those opportunists that joined purely to profit.. and especially those that joined on borrowed money.. are getting flushed out in a gigantic tsunami. Sadly, they are taking out a number of long-term investors and traders that bet big and over extended themselves, along with a number of new projects that only had good intentions,” he told Finance Magnates.

Be First to Comment