On Wednesday, the (ESMA) released a statement regarding the clearing and trading obligations that are set to be put into law on the 21st of December this year.

A series of laws have come into play over the past few years as a result of (EMIR). Essentially, the regulation forces firms to clear specific over-the-counter (OTC) derivatives with (CCP).

Until now, different firms have had different time frames to start adhering to that regulation. Starting in 2015, the regulation has come into effect on the 21st of December of each year since.

In 2017, companies below a €8 billion ($9.05 billion) threshold had their ‘start date’ for the regulation postponed until 2019. Now the regulator is having to clarify other postponements to companies.

NFCs not Obligated

The statement issued by the regulator, in its usual impenetrable fashion, on Wednesday indicates that clearing obligations regarding “certain intragroup transactions concluded with a third country group entity” won’t come into effect for another two years.

Those rules, which were supposed to come into effect this year, will now only become law on the 21st of December 2020.

Regarding rules for non-financial counterparties NFCs, rules that were supposed to come into effect this year will indeed come into effect this year.

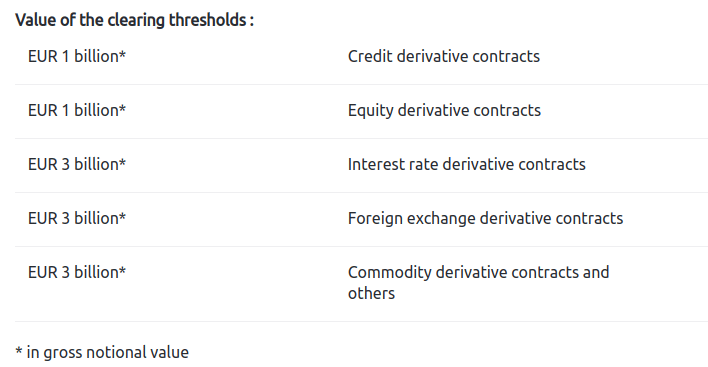

Having said this, the regulator also noted that, for NFCs, those clearing obligations would only apply if their activity in any given asset class, including the interest rate derivatives market, is above the clearing threshold.

Thresholds vary depending on the asset class but, as can be seen in the above photo, range from €1 billion to €3 billion.

Be First to Comment