This is the first article in a four-part series which aims to dive into the various aspects of human resources in the forex industry and uncover the current and future trends.

Over the past 12 months, the foreign exchange (forex) industry has changed astronomically – particularly in the European Union. This, of course, is in reference to the suite of regulations which the (ESMA) has implemented this year. So how has this impacted the job market?

Brokers are less forgiving of “infidelity.”

Only five years ago it was acceptable for someone to leave the forex industry in the pursuit of other passions – such as fintech or investment banking. They could leave for a few years and be welcomed back with open arms.

However, it appears that brokers are now less forgiving of this “infidelity.” Now, they are looking for candidates with consistent experience in the forex space – without interruptions.

Source: LinkedIn

“Now, they [brokerages] want consistent experience within the FX space working as a recent CF10 or CF11. Obviously, that’s very UK-focused. Still, needing that direct relevant experience [is important]. Before, they were giving you the opportunity to take two-three years out and then go back.”

CF10 is the simplified code name given by the Financial Conduct Authority to the compliance oversight function. This function is often held by the Chief Compliance Officer of a financial institution.

Not only do brokers want to hire candidates that have shown loyalty, but they are also now more demanding. Reece Pawsey explains this by saying that forex salespeople looking for a job need to bring an existing book of clients with them. In addition, this client book needs to match the broker they are applying to. This has especially become a trend in the United Kingdom.

Experience and education are big winners

Competition has always been fierce within the forex industry – both between candidates and brokers. So what can candidates do to stand out from the crowd? It seems that there are two main selling points that brokers are really after – experience and education.

Previously, certain roles didn’t require degrees, such as mid-level and head of compliance roles. However, now, it is a prerequisite.

“Say for example in Cyprus, they didn’t need to have a legal degree to become . Now that’s an absolute prerequisite… So they are definitely tightening the requirements for the role. Much more so than maybe a year and a half – two years ago,” Pawsey said.

Not only is education important, but experience – and as mentioned before, consistent experience, is a big winner for firms looking for candidates. Finance Magnates also sought the wisdom of Ioanna Vlassi, the executive director and owner of Unirec, a firm specialising in strategic consulting and executive searching in finance and fintech.

Source: LinkedIn

“Back in the days when I started, there were a lot of companies who were new and they didn’t have the ability to onboard professional people because the professional people with a lot of experience, they were choosing more established companies to go. So the industry back then was a bit more open to people with not much experience.”

Who has the power – brokers or candidates?

Like any relationship, it goes both ways. Candidates need to offer more, and as a result, brokerages need to pay more. But we’ll go into that more in the third article in this series.

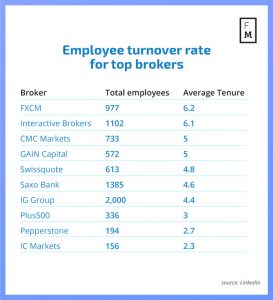

One thing that has plagued the forex industry for a long time is a high turnover rate. Particularly in mid-level and junior positions. This would make it seem that candidates have the upper hand, as they have a large choice of positions.

Taking a look at some of the top brokers in terms of trading volume as of the second quarter of this year, FXCM, a London-based international provider of online foreign exchange and CFD trading, had the longest average tenure.

However, the length of the tenure isn’t that long at 6.2 years. IC Markets, which is an Australian-based online ECN forex broker firm and the second largest broker in the world had the lowest average tenure of only 2.3 years.

However, while high turnover has been a characteristic of the forex market for some time, it is important to note that shorter tenures are part of a larger global trend of employees both within and outside of the finance industry.

In the UK, it is becoming increasingly common for employees to change their job every few years. According to research conducted by life insurance firm LV=, a worker in the United Kingdom will, on average, change their job every five years on average.

Source: LinkedIn

How can brokerages keep their talent?

So how can brokers keep their employees? Well, one of the most effective ways, according to Nastasia is a flexible work-life balance.

“We have seen increasing numbers of organisations in the UK, Europe and Cyprus that are working on ways of having flexible working options for their employees. So, that is one of the… recommendations for what to do to decrease staff turnover.”

In the next article of this series, we will take a look into what are the “hot” positions, is limiting jobs and more, so be sure to keep an eye out.

Be First to Comment