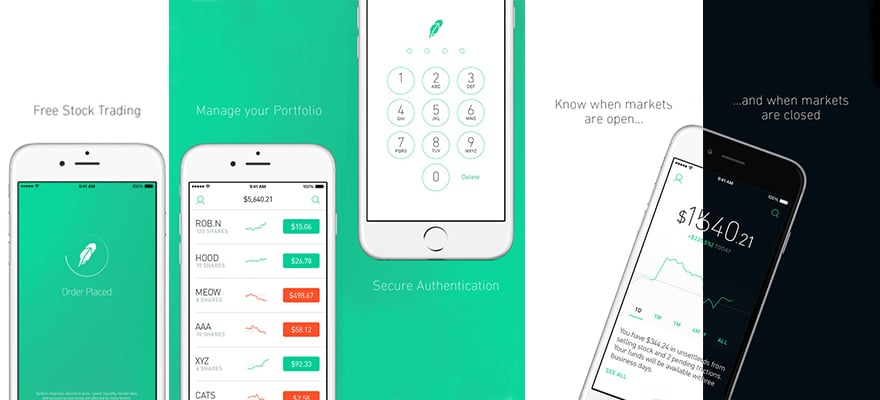

Robinhood has announced that it is implementing a new approach towards clearing. The remarkable user growth which the company enjoyed since it launched its free stock trading app has netted it a user base surpassing 6 million people.

Robinhood’s move is paving the way to increase its revenues. The firm has just gotten rid of a key middleman. Further emphasising on low trading fees, the independent brokerage is becoming a custodian which clears and settles trades.

The firm’s development team worked on the “Clearing by Robinhood” system over the past two years. The company established a unit called Robinhood Securities all the way back in 2016.

Challenging Low-Cost Brokers

With its move, Robonhood joins the ranks of Charles Schwab, E-Trade and TD Ameritrade. The firm is entering the big league when it comes to valuation too. According to Pitchbook, the firm’s value now is close to $5.6 billion.

Its main competitors are still larger by orders of magnitude, but the firm added another 1 million customers since August. Previously the firm added the same figure between May and August of this year.

E-Trade is at around $13 billion, TD Ameritrade at $29 billion, while Charles Schwab’s market cap stands at $67 billion.

Migration and Fees Reduction

While has been executing the orders of its clients at zero costs, the brokerage has been charing some other fees. Those are now rescued further due to the cost optimisations resulting from internal clearing.

Broker assisted trades and restricted accounts which used to cost $10 are now free. So are the voluntary corporate actions and worthless securities processing which were previously $30 and $50.

The brokerage is coming under pressure in recent months after securing its Series D funding. Only a year ago the firm was worth $1.6 billion.

Be First to Comment