Ever since began its ICO project, the company has been working to deliver a fully-functional version of its exchange platform to the market. The firm, which was founded by Kevin Murcko, who is also the CEO of forex and CFDs , is now deploying its open beta.

The release comes only six months after the company concluded its ICO in which it raised $15 million and follows the deployment of a closed beta in July of this year.

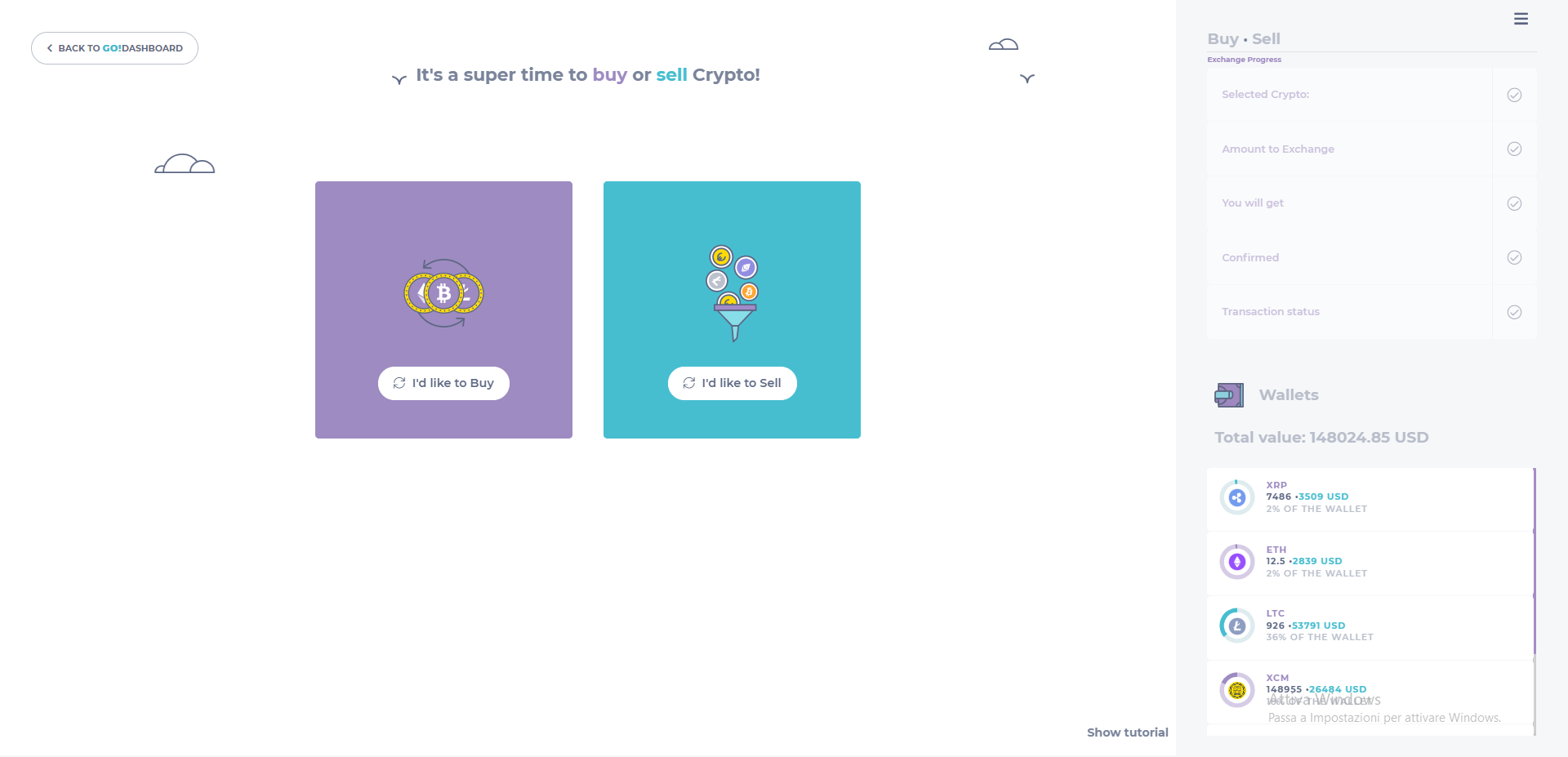

Simple vs Intermediate Exchange

The beta product version of the tokenized exchange platform CoinMetro includes two options for customers. The most minimalistic and user-friendly interface is called “simple exchange”. The view delivers to clients a simple screen where they can purchase or sell the asset they are looking for.

According to the company’s plans, the full platform is expected to go live later this year.

The Details

CoinMetro’s beta exchange platform gives users access to a variety of important features for traders. Real-time market data provides access to quotes, charts, an order book, and an overview of the client’s wallet.

The beta launch includes BTC, ETH, XRP, LTC, BCH, and the US dollar. Users also have access to community features of which a chat with other users within the platform stands out.

Commenting on the launch of the beta, Murcko said the company has identified a need to deploy a platform which is for both beginners and advanced traders.

“With our current version now live for the public, we’re showcasing just how far we’ve come in achieving that goal. Our web-based beta has been built with ease of use in mind and is a major stepping stone in terms of our ultimate goal of producing a fully-integrated and regulated exchange, trading, and ICO platform,” he said.

The FXPIG team, which is behind CoinMetro, aims at delivering a trader-friendly exchange to the market.

During the advent of the crypto space, most of the focus of exchanges has been to deliver a platform which is focused on long-term investors.

“We’ve listened intently to all the feedback we received during our closed beta, and have implemented as much as possible for the open beta experience. We really value the CoinMetro community and their continued support, and we’re looking forward to receiving valuable feedback during this period,” Murcko elaborated.

The company is also looking to finalize a trading platform and an ICO platform before the official launch. Next in line are a professional asset management solution and crypto ETFs. The company has chosen Estonia for regulation.

The firm is also in the process of acquiring an e-money license from the UK’s Financial Conduct Authority. Plans for Australia and Mexico are also in the working.

Be First to Comment