NAGA Group is a Frankfurt-listed firm that has a suite of products which include mobile . Last year the company also raised $51 million with .

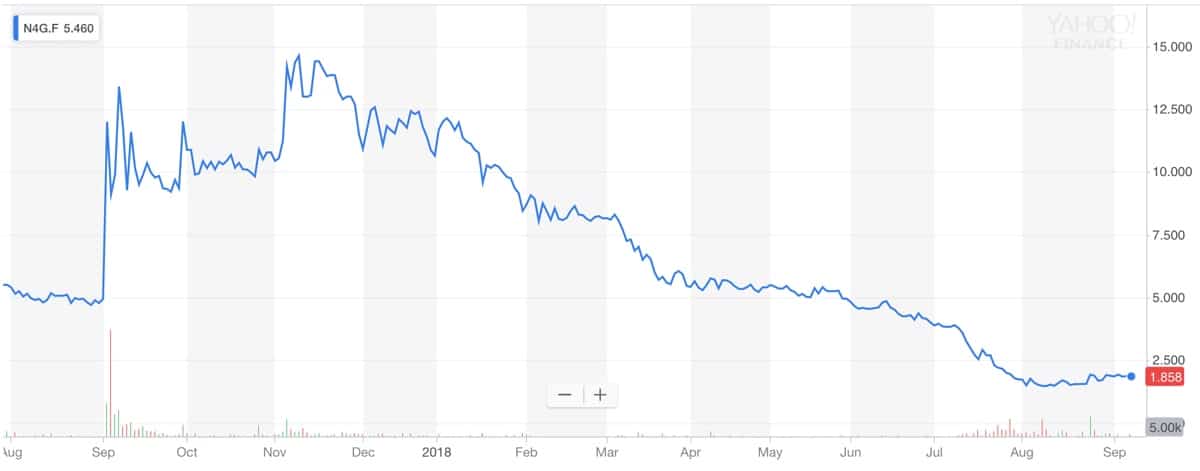

According to the roadmap of the firm, the firm is set to launch an exchange for cryptocurrencies and gaming items in October. The company’s stock is close to all-time lows. After debuting on the valued at around €200 million, the firm’s current valuation is closer to €40 million.

A month into the new regulatory framwork from the ESMA, the industry is looking at a radical shift in client behavioir. The ecosystem on which NAGA has been working is launching at a time when user acquistion costs have skyrocketed, while trading volumes across Europe are on a declining trend.

Geographical diversification has become crucial for the survival of the industry as brokers are looking for new clietns from emerging markets. At the same time EU clients are looking for offshore brokerges to deposit their funds to.

NAGA Markets is offering its own propriatery NAGA Trader app as well as MetaTrader 4. The stadard offering of the firm comes at a time when the industry is increasingly dependent on diversificaiton. The key to attracting and retaining clients will be in the firm’s ability to offer a unique product.

NAGA Exchange

According to the post-ICO plans of NAGA Group, the firm is preparing to launch and exchange for cryptocurrencies and gaming items. Provided that there are no delays, the launch of the venue comes at a time when interest in trading cryptocurrencies has significantly declined.

The challenge for Mr Warnecke is to run the brokerage side of the group at a time when the retail business which is focused on Europe is experiencing a major transition. That said, he has almost 20 years of experience in the brokerage industry, spending most of his career at Hanseatic Brokerage Securities in Hamburg.

Be First to Comment