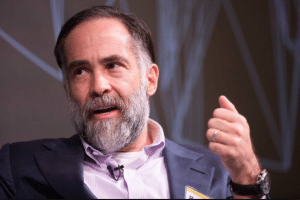

Rumours that Goldman Sachs is have been dismissed as “fake news” by the company’s Chief Financial Officer. made the statement on Thursday at a tech conference in San Francisco.

His comments came after Business Insider issued a report on Wednesday, suggesting the financial services giant would be scrapping its plans to trade cryptocurrency. The report stated that an uncertain regulatory regime meant Goldman was instead focusing on developing custody services for cryptocurrency.

Following that report, the price of bitcoin fell by around $300 in the space of an hour. The news that such a big institutional player was retreating from the market may have been part of the reason for this collapse. Bitcoin had, however, also reached its highest price in August and traders may have simply been selling off in order to make some cash.

Goldman Sachs exploring bitcoin NDFs

In July, for instance, the price of bitcoin rose above $8,000 after reports of a. When those plans were , the price plummeted to below $7,000.

If cryptocurrency fans do want more institutional involvement in the market then Chavez’s other claims should please them. The CFO said that Goldman is exploring non-deliverable forwards in cryptocurrency. He added that his firm was pursuing a derivative of bitcoin because “clients want it.”

Bitcoin has struggled to return to the former heady heights of December 2017 when it was trading at $20,000. In fact, the market capitalisation of the entire cryptocurrency market is down 63 percent this year according to research data from CoinMarketCap.com

Be First to Comment