Over the past several quarters we have been witnessing a growing number of companies which are having a go at delivering a cryptocurrency exchange solution. The significant technological challenges associated with such products and the unregulated nature of the cryptocurrency market have mostly yielded products which are of questionable value.

Instead of delivering a competitive solution on par with existing crypto exchanges, the product mix is focused on aggressive sales tactics and exorbitant commissions. These have been traditionally associated with binary options brokerages and high-commission unregulated forex trading.

Building a Crypto Exchange the Right Way

Identifying a market gap, Spotware Systems has ventured into the space and committed to building cXchange. The company’s product is an out of the box cryptocurrency exchange. It includes a backend, a matching engine, post-trade surveillance, a frontend, and it can be either be hosted by the developer or by the company purchasing the software.

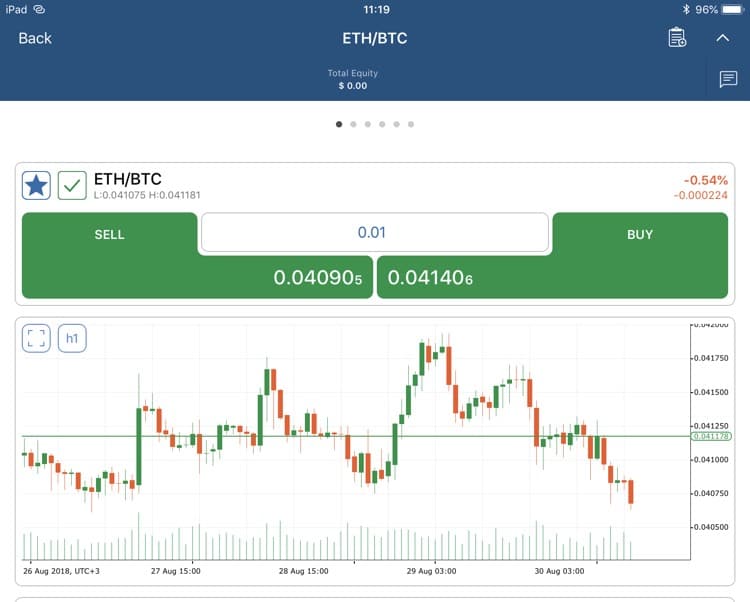

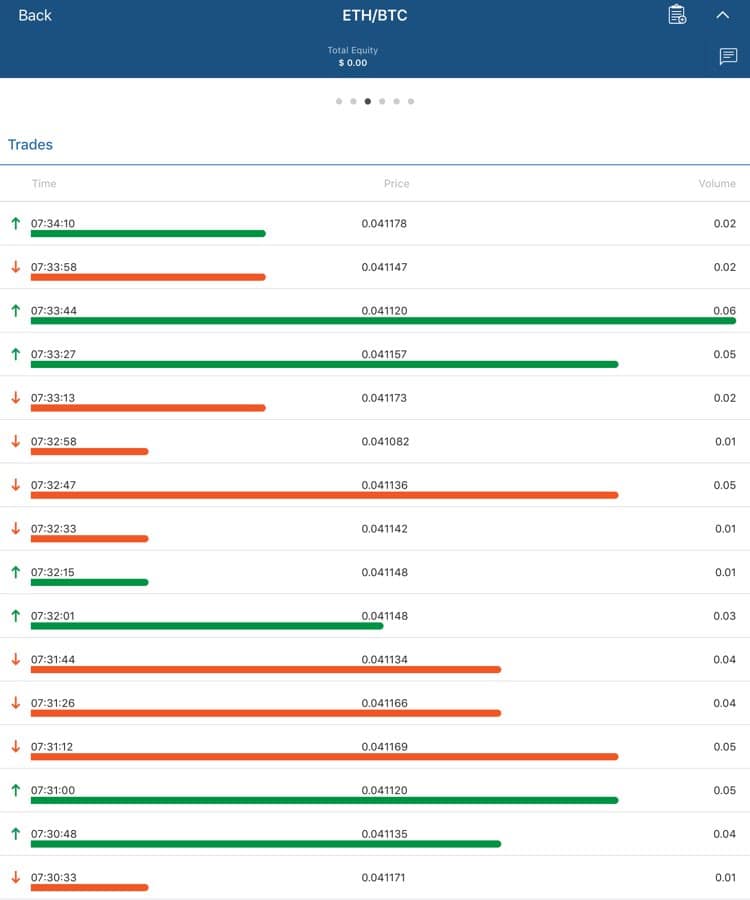

The clunky and heavy user interfaces used by traditional cryptocurrency exchanges are nowhere close to what Spotware has acquired with its years of experience with cTrader. The trading environment is providing a concise look at orders, open positions, market data, etc.

Functionalities for Exchange Operators

The exchange operators also have access to a variety of tools and data. cXchange delivers a back office where the exchange can manage the trading environment, do post-trade surveillance, and have a glimpse at trading orders. Different groups of customers that pay different commissions are available alongside one of the notable perks of cTrader, which is a referral program.

Exchange operators will have to negotiate liquidity connections on their own. This contrasts with the approach of other providers in the area who tend to clone data from other exchanges. Spotware has instead partnered with a multitude of market makers who are open to collaborating with exchange operators.

Integration over FIX API guarantees the operators access to multiple market makers. The support of the protocol is another perk to traditional financial industry aficionados, who tend to prefer products which are already proven and established.

The product is integrated with a number of wallets, one of those being BitGo. There are no limits on the amount of assets which can be offered via Spotware’s crypto exchange

Spotware’s Trading Expertise

The main advantage of Spotware’s cXchange when compared to other crypto exchanges is that from the get go this is a trader-focused product. In contrast to a number of cryptocurrency exchanges out there, where a trader’s user experince wasn’t at the core of the product, the case here is different.

The gap in the market which exists between traditional crypto exchanges and traditional financial markets traders is therefore closed. The only element that seems to be missing right now from the market is another cryptocurrency market uptick. For those who are looking to get in on this asset class, looking at Spotware’s product might prove valuable in the long run.

Be First to Comment