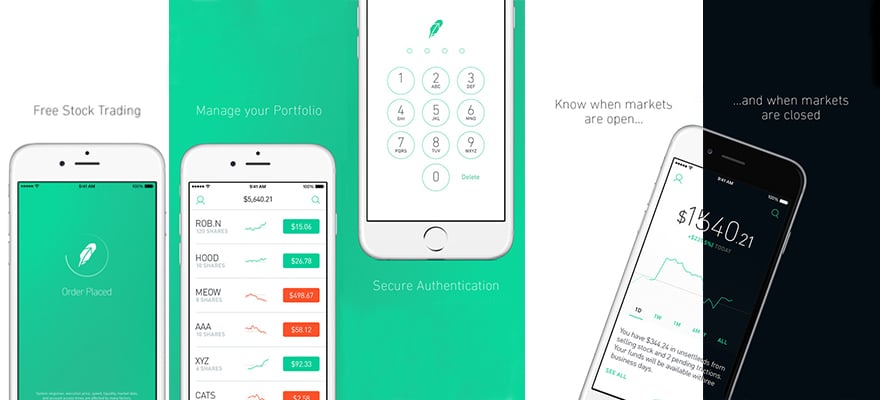

Commission-free trading app Robinhood is updating the list of stocks it is offering to its clients. The company has announced in a blog post that it is enabling trading of American Depositary Receipts (ADRs). The new addition will provide clients of the company with over 250 new global stocks to select from.

The new shares which will be avaibale for commission-free trading includes companies listed in Canada, China, Germany, Japan, and the United Kingdom. The list includes companies such as Adidas, BMW, Heineken, Tencent and Nintendo, and extends the no-fee trading trend at retail-focused outlets.

Robinhood has been at the core of an industry-wide trend in the US, as retail traders started getting access to the market for little or no fees. The ongoing expansion of available assets will continue in the coming months with the addition of French stocks.

Commission-Free Trading for Retail Investors

US retail investors have been adamant to embrace the evolution of the brokerage market place. Robinhood has become a pioneer in the industry with a massive user base currently being estimated at about 5 million accounts. The latest funding round through which the company went, valued the firm at $5.6 billion.

JP Morgan’s You Invest app which debuted this week is the company’s response to the massive decline in commissions for retail investors. The big bank’s response to companies like Robinhood is to provide its clients with 100 free trades per year.

Low commissions brokerages such as , and TradeStation are facing an increasingly agile competition. If a retail investor’s approach towards the market is to buy and hold, traditional brokerage houses have become much less attractive than they used to be.

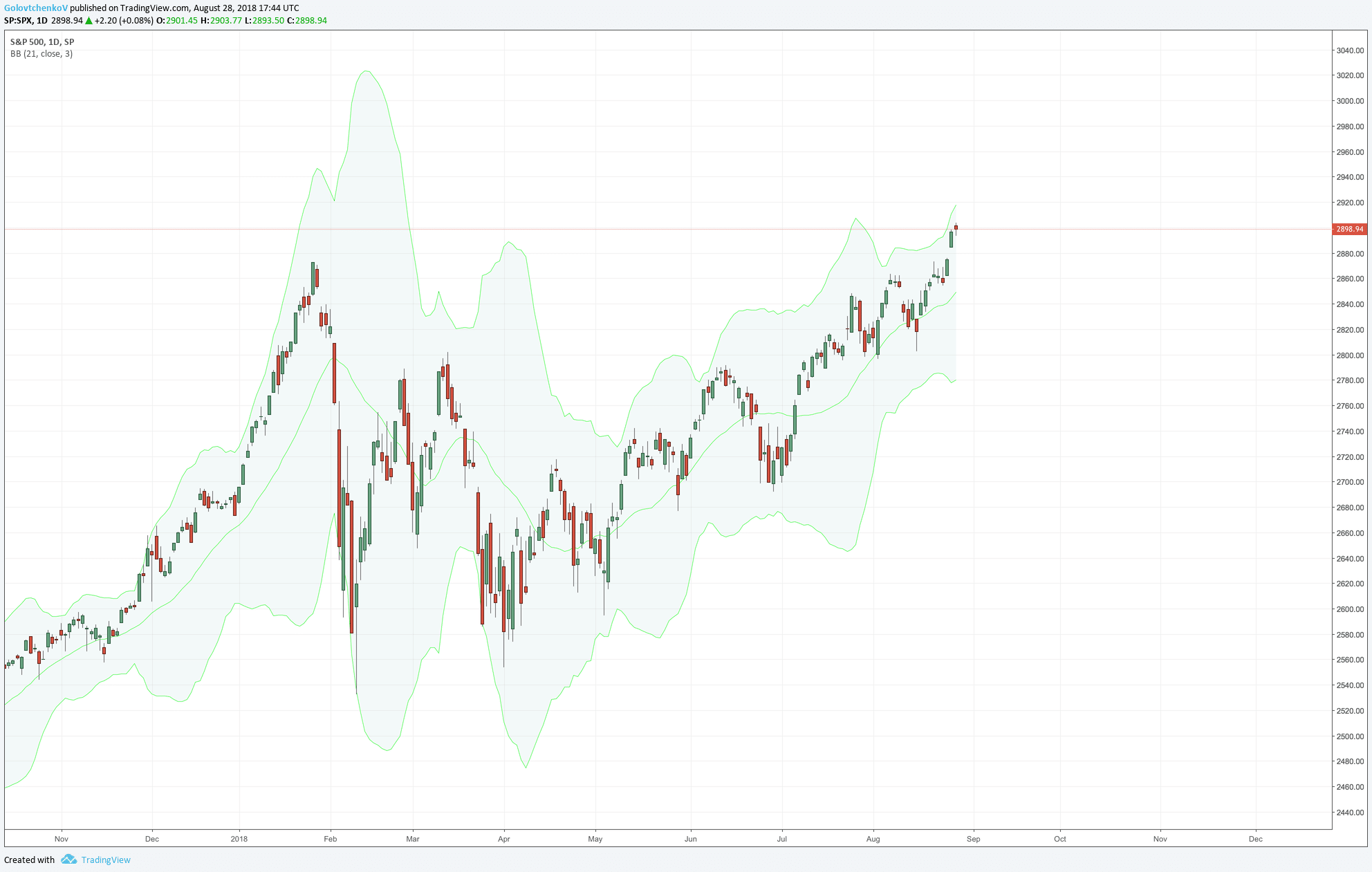

Buying into a Bull Market

Stock brokerage houses have been alarming the retail crowd since the start of the year that their holdings are at an all-time high. This typically coincides with a period of significant market corrections. While we already saw one in February, the exposure of retail investors today is still around all-time records.

As to Robinhood, this isn’t the company’s first breakthrough this year. Back in February, the brokerage aimed at disrupting the . With its massive user base growing rapidly, the firm has been gradually expanding the number of products it is offering to its clients.

Robinhood Crypto is coming to Georgia, and we’re feelin’ peachy! Trade cryptocurrencies, commission-free. 🍑

— Robinhood (@RobinhoodApp)

The vision of the Co-Founder and CEO of Robinhood is to run the business in a way that allows the firm to break even. That’s some tough competition for publicly listed discount brokerages which have been the traditional stop for retail investors.

Be First to Comment