Commission-free investing app Robinhood has opened cryptocurrency trading to another American state, this time bringing the derivative product for residents in Texas. Expanding the service reach comes after Robinhood’s crypto initiative got off to a good start over the past few months in select states.

The competitive landscape for cryptocurrencies in the US is heating up. Just yesterday, Coinbase announced that it is moving forward with a plan to acquire licensure that would allow the company to begin offering blockchain-based securities and participate in the . The company has also acquired the broker-dealer Keystone Capital Corp., based in California.

Texas, we’re not messing with you. You can now trade Bitcoin and Ethereum commission-free, on Robinhood Crypto. 🤠

— Robinhood (@RobinhoodApp)

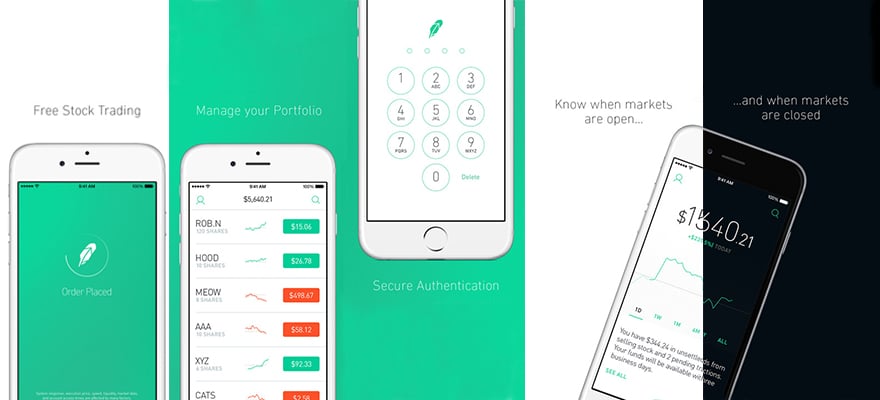

Robinhood’s offering is particularly popular among the “millennial” population, who appreciate the ease of using the app to trade several asset classes without fees. As for the crypto offering, the platform offers no-fee Bitcoin and Ethereum trading services.

Texas joins a handful of states that were added over the last two months as part of a phased market rollout that is moving along. Last month, Robinhood became available in two cryptocurrency-friendly states: .

Growing at an explosive rate

Robinhood Crypto got off to a good start in late February for residents in f – California, Massachusetts, Missouri, Montana, and New Hampshire.

The announcement triggered a flurry of responses on Robinhood’s Twitter account, ranging from requests to add more cryptocurrencies to asking the company to expand to other states.

Robinhood seeks to carve out its niche by letting traders buy and sell cryptocurrency for $0 a trade. In doing so, the company plans to make money from order flows, a common tactic used by discount brokers to generate revenue by directing orders to certain trading venues. The company also receives interest on unused cash deposits from user accounts and offers a premium paid account for $10 per month, which gives users added features.

The six-year-old startup has been growing at an explosive rate. For now, Robinhood can keep its free platform afloat through compromises such as not having many physical locations, maintaining only a small staff for client service, and not spending on massive promotional campaigns.

Also in May, Robinhood raised its , bringing in $363 million at a $5.6 billion valuation.

The Silicon Valley company said that it would use the funds to increase hiring and develop new products around its stock trading app, which has more than 4 million users.

Be First to Comment