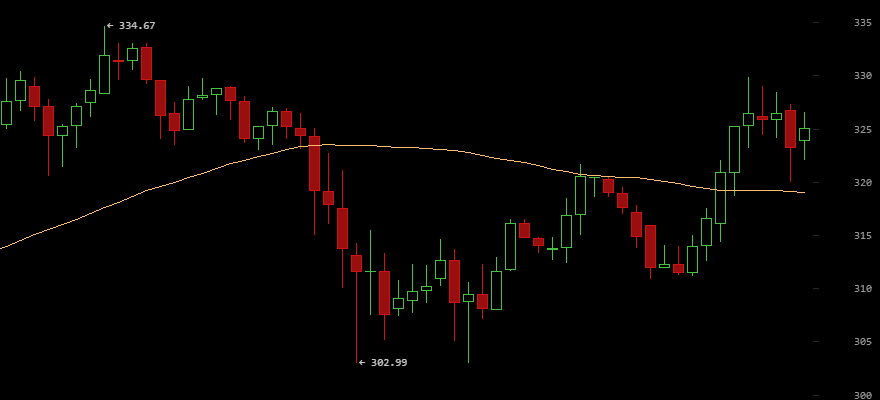

Bitcoin (BTC/USD) revisited $330 on Bitstamp, challenging a 2015 high of $335 reached two days ago.

Trading has become noticeably unsettled this weekend, and volatility has increased since bitcoin convincingly and entered into positive year-to-date territory for the first time in 2015.

The peak of $335 was bitcoin’s highest level since December 24 last year, and leaves traders wondering whether we’ll see another November explosion or if the month-long rally is a bubble that will soon deflate.

Bitcoin had gained more than 50% since testing support near $220 in late September. After hitting its peak, it retraced by roughly 10% in less than 24 hours, surrendering all gains realized during the previous 48. Holding its ground above $300 on most exchanges, it has now recouped most of the gains.

The unstable trading environment is most pronounced by the wide price disparity between exchanges. The price on BTC-e is currently $308, while the USD equivalent on Huobi is $353- a difference of 12.7%.

The significantly higher prices on Chinese exchanges suggest that the most recent legs of the rally, which have been the most intense, are China-driven. If true, the situation mirrors the China-led explosion of late 2013 and is analogous to the dramatic moves, propelled by Chinese retail traders, on the Shanghai Stock Exchange during the past year.

In any event, bitcoin has already achieved a major milestone in staying above the $300 mark for an aggregate of nearly 5 days- previous attempts fizzled after 24 hours- and even trading in positive year-to-date territory for an aggregate of 30 hours.

Litecoin Surprises

Litecoin (LTC/USD) suddenly and unexpectedly spiked by 33% to as high as $3.95 heading into the weekend, hitting its highest level since August 17. It has since trended lower, currently trading at $3.62.

The spike came on a 24-hour volume of roughly 840,000 LTC ($3 million) on BTC-e, more than 10x the average during the preceding 30-day period.

Litecoin had been highly unresponsive to bitcoin’s hot streak- in contravention of its typical behavior in hyped markets, but not necessarily so for when they’re calm. Conspiracy theorists may argue that litecoin’s price had been artificially suppressed until now, and that equilibrium has been re-established with the plug removed.

There is speculation that big-name bitcoin exchanges Coinbase and Gemini are thinking of adding the coin, based on apparent observations in Coinbase’s backend and the wording in a recent Winklevoss ask-me-anything (AMA) session.

It’s worth noting that in the wilder days of 2014, it was not uncommon for altcoins to soar on reports of their consideration for support in major exchanges, but they often fell hard when the hype subsided. A good example is to BTCC, formerly BTC China, last year.

Another theory, perhaps more credible, is that an oversized buy order for LTC was poorly executed. This theory would be validated by a steady decline in prices throughout the coming week.

The LTC/BTC rate shot above 0.0124 after falling to 0.00965, the lowest level since mid-June.

Be First to Comment