Being a trader on the foreign exchange and CFDs markets for over 10 years has taught the author of this article about the dangers of one certain aspect of retail trading – leverage. While a number of brokers have started marketing to their clients how they can profit big time with leverage, the losses aspect is often misrepresented.

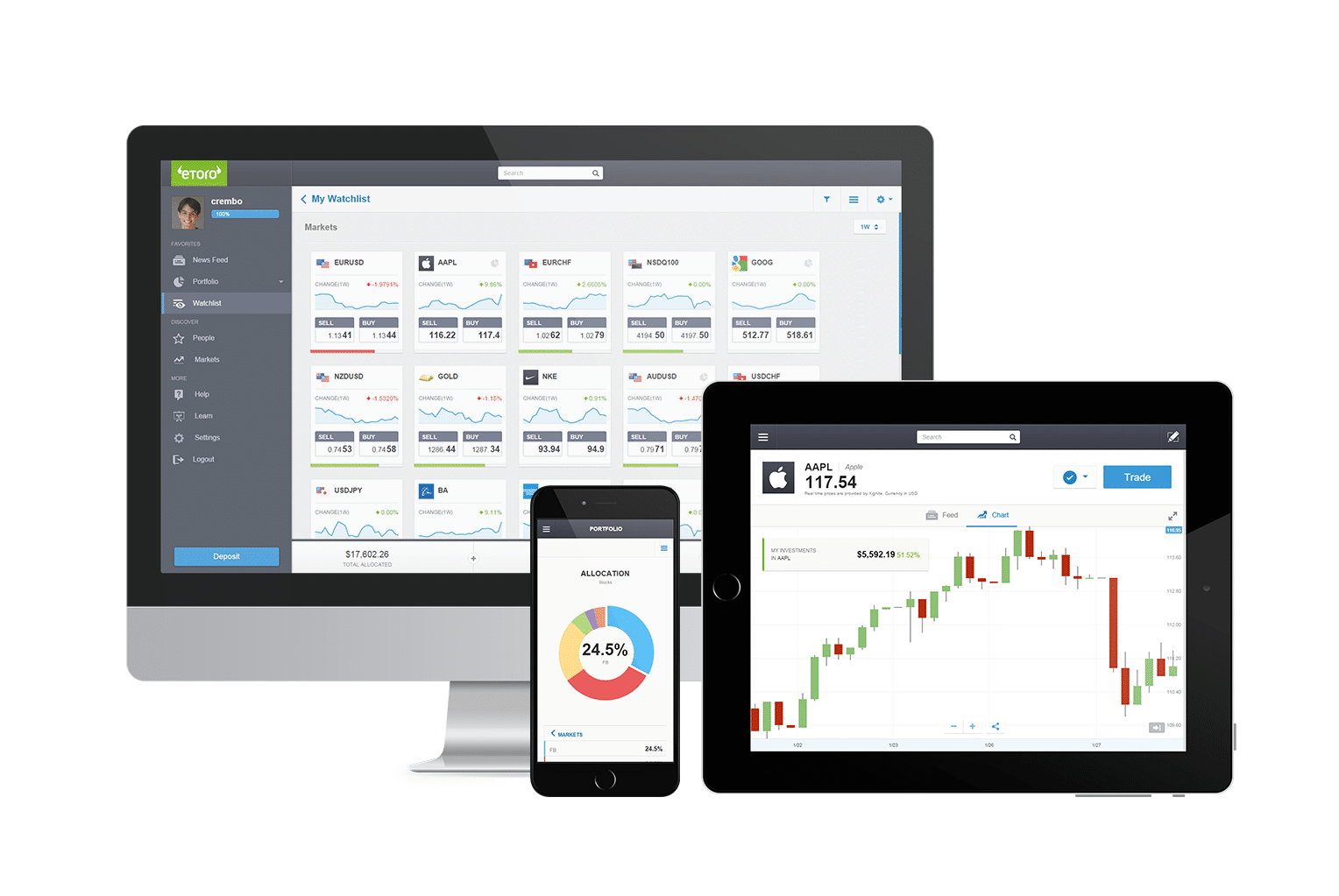

There are of course exceptions, but for the most part, retail traders are led to believe that getting as much leverage as possible is somehow beneficial for them. eToro has become one of the few companies which have taken on a different course. Merely a month after the company has introduced no leverage trading for forex, the brokerage is beginning to provide this option for traders of indices.

leverage has become so common that traders tend to forget the risks involved

The company’s announcement back in August puts it quite clearly: “In the world of currency trading, leverage has become so common that traders tend to forget the risks involved in leveraged trading – after all, it means investing money that you don’t have!”

After today’s update, losing massively by trading one of the more volatile asset classes around may become much more difficult for traders using eToro. The company is taking an important business sustainability move by introducing no leverage trading. While some regulators across a number of jurisdictions have been vocal about high leverage, this is far from the case in Europe.

Granted, the argument that trading volumes with no leverage are much lower stands, yet why not give customers a choice? The sustainability of the business model of brokers does not have to depend on providing high leverage, because sooner or later retail traders’ losses due to access to high leverage will pick up regulatory attention.

By making this simple move, every broker may increase the retention rate of its clients, and in the case of eToro, with social trading services, the move can be even more beneficial for the company in the long run.

Be First to Comment