Arriving closer to its launch date, has announced that it has raised $1.12 million in new funding. The round included participation from Bialla Ventures, InfoSpace founder Naveen Jain, veteran trader Vuk Bulajic, Vinh Vo and founder Chris Kitze.

Partnering with banks, of which initial ones are expected to be announced in Q4 2015, Safe Cash is creating a digital token system for the transfer of cash. Unlike other digital currencies such as bitcoin which are aimed as an alternative to online and card-based payments, Safe Cash’s product is aiming to compete with physical cash.

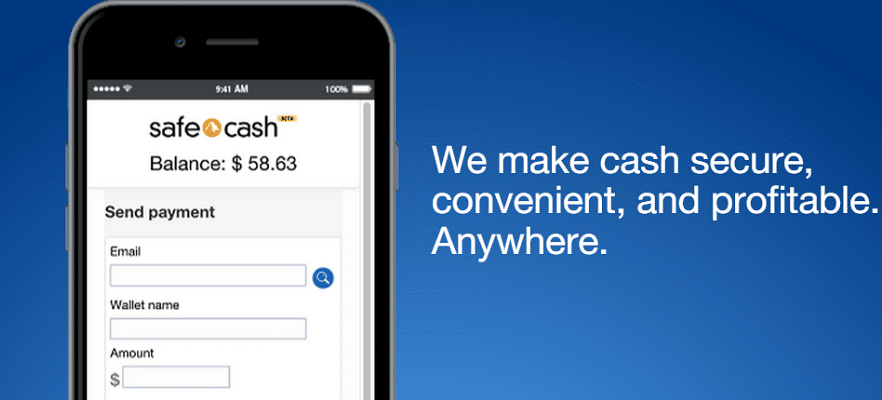

Working with their partner firms, Safe Cash customers will be able to purchase digital tokens with cash. The tokens will represent fiat currency and be transferred between users through Safe Cash wallets that will be available for iOS and Android mobile devices and other mobile platforms. Digital tokens will also be available to exchange back into cash at any of Safe Cash’s partner banks.

We’ve taken the universally accepted currency of cash and made it digital

Overall, the token system is being developed not as an entirely new currency, but one to operate hand in hand with fiat. As such, Safe Cash is aiming to introduce its tokens for US dollars, euros and other major currencies. In regards to its strategy, Safe Cash Founder Chris Kitze explained in the firm’s prepared remarks, “Instead of asking how to make a digital token like bitcoin more globally accepted, we’ve taken the universally accepted currency of cash and made it digital.”

Kitze added, “Safe Cash is a secured digital payment system that enables banks to do things they can’t do now. Consumers and merchants will greatly benefit from person-to-person e-commerce, store of value without digital asset fluctuation risk, and eventually, cross-border payments and remittance.”

Be First to Comment