Orchard Platform announced that it has partnered with Kabbage. According to terms of the deal, Orchard Platform, which provides investment and analytics technology for the marketplace lending industry will become integrated with Kabbage’s Karrot consumer lending offering. As a result, Orchard Platform users will now be able to use the software to analyze deals on Karrot for potential investment.

As part of the deal between the two firms, Kabbage will begin to use Orchard Platform’s technology withi their own operations to grow their consumer lending business unit, Karrot. Launched in September, Karrot expanded Kabbage’s lending services, which had been limited to business loans, to the consumer market.

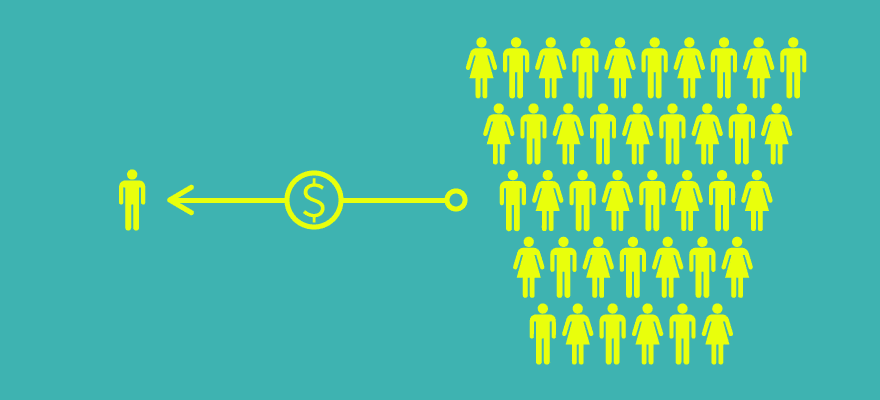

Similar to P2P lenders, Kabbage uses marketplace lending technology to allow borrowers to make loan requests online and receive answers of terms within minutes. Unlike P2P lenders that provide a marketplace for investors to choose which borrowers they want to provide loans to, Kabbage acts as the lender through a partnership with Celtic Bank of Utah. Since its launch in 2011, Kabbage has issued $700 million in loans to businesses. For Kabbage, the current deal with Orchard Platform will assist them in continuing to expand their services beyond just the business lending space, as they have also recently begun to license their software to external financial firms.

Discussing the partnership in the public statement, Kevin Phillips, Chief Financial Officer at Kabbage, said “We see Orchard disrupting the institutional sales space in much the same way that Kabbage has disrupted the lending space. The Orchard Platform is a highly scalable, technology driven complement to our direct sales program.”

Matt Burton, CEO and Co-Founder of Orchard Platform, added “Kabbage is a pioneer in the use of novel data and advanced analytics for issuing credit,” said Matt Burton, CEO and Co-Founder of Orchard. Adding, “We’re thrilled to be bringing them onto the Platform and to be supporting them as they seek to expand investment in their Karrot lending business. This partnership reflects the changes taking place in the world of credit, where data and transparency are paving the way for skilled lenders to create products that fit the needs of today’s borrowers while allowing these loans to be funded through a scalable and data-driven marketplace of sophisticated investors.”

Be First to Comment